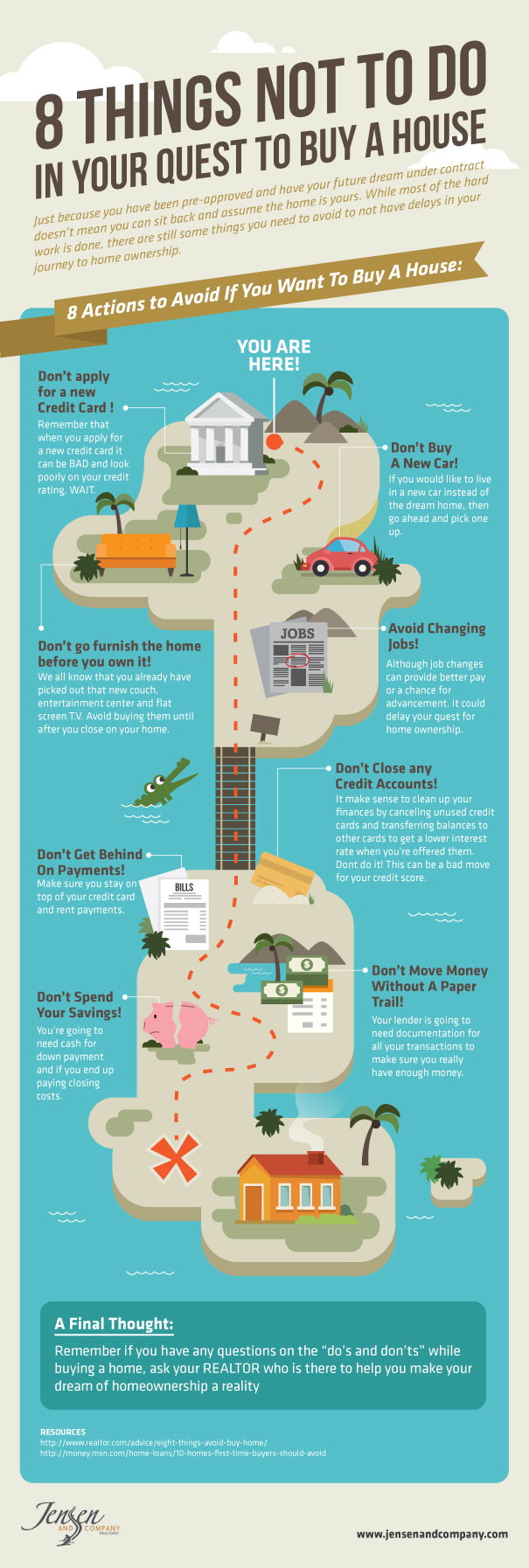

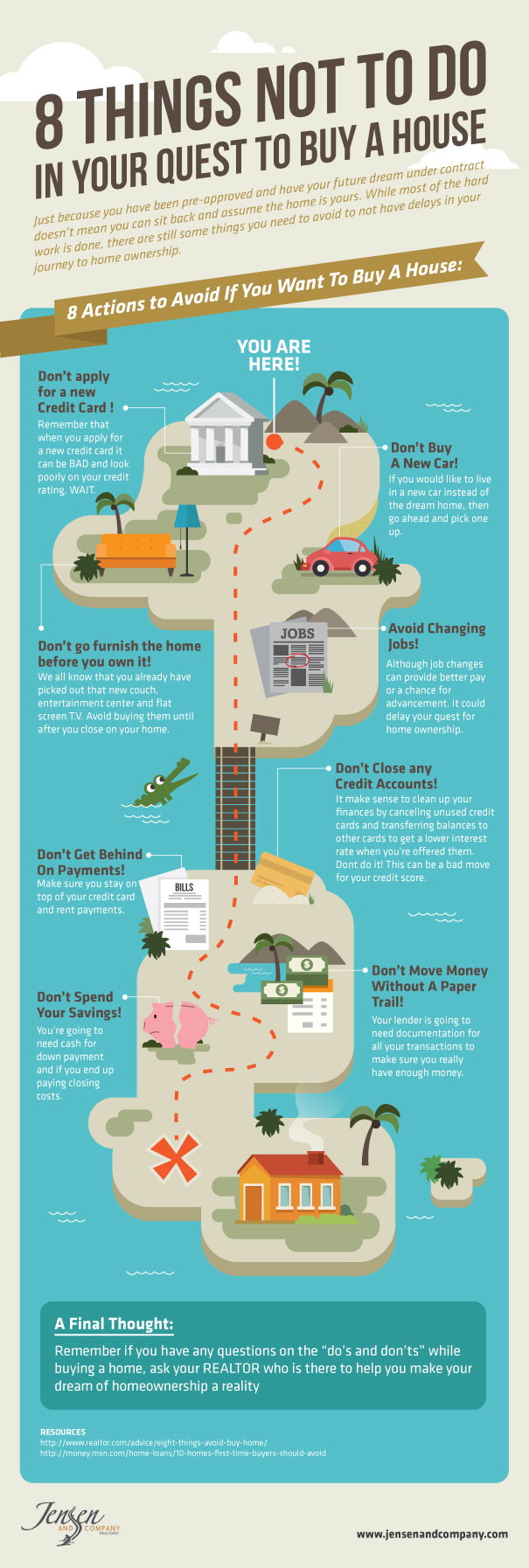

One of the biggest mistakes many people make once they’ve put a home under contract is assuming the home is theirs. But, truth be told, it’s not yours until you have those keys in your hand. Until then, there are certain things you need to avoid to ensure your home buying process goes smoothly. Any delays could mean not becoming a homeowner anytime soon.

8 Actions to Avoid If You Really Want That Home

8 Actions to Avoid If You Really Want That Home

1. Don’t go out and finance a car. Once that home is under contract, closing escrow needs to be your top priority. Your lender wants to be sure you can afford the home you’re trying to buy. Adding a new car payment to your debt-to-income ratio at the last minute is a great way to make your lender lose faith in your ability to pay your mortgage on time.

2. Don’t change employers. Job stability is one of the factors that got you approved for a mortgage loan so far. Starting a new job after your home is already under contract takes away that stability. That makes you more of a risk to the lender, who may not approve your loan because of it.

3. Don’t close any accounts. Your credit scores were very important factors when the lender approved you to put the home under contract. Any changes to your credit accounts will cause your scores to drop, including closing out accounts. So, until escrow closes, leave your credit alone.

4. Don’t touch your money for now. When it’s time to write that check for your down payment and closing costs, the lender will want to know where the money is coming from. You must be able to show where it’s been sitting all this time. So, just leave it be for now, so your paper trail will be easy to verify.

5. Don’t apply for new credit cards. You want to show the lender that the most important thing to you right now, is buying the home you have under contract. Applying for new credit cards shows that you’d rather be out shopping than preparing to get into your new home. Plus, the inquiries will cause your credit scores to drop.

6. Don’t furnish a home you don’t have yet. It’s one thing to go out looking at furniture simply because you enjoy dreaming about furnishing your new home. But, buying furnishings for a home you don’t have could be a really bad idea. What if the lender requires a larger down payment, or the seller insists you pay the closing costs at the last minute? You’ve already spent it on furniture.

7. Don’t start making late payments. Remember, your lender will run your credit again right before closing escrow. Late payments this late in the game will give the impression that your mortgage payments will also be late. Bad idea.

8. Don’t bother your savings. Your savings will ensure you can come up with your down payment, and closing costs if needed. Make sure you don’t lose out on buying your dream home because you’re short a few bucks at the last minute. Just wait until you have your keys first.Interested in buying a home in Park City, Utah? Jensen and Company has been helping people become homeowners in Park City since 1988. Contact the Realtors at Jensen and Company about buying your Park City dream home today

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal