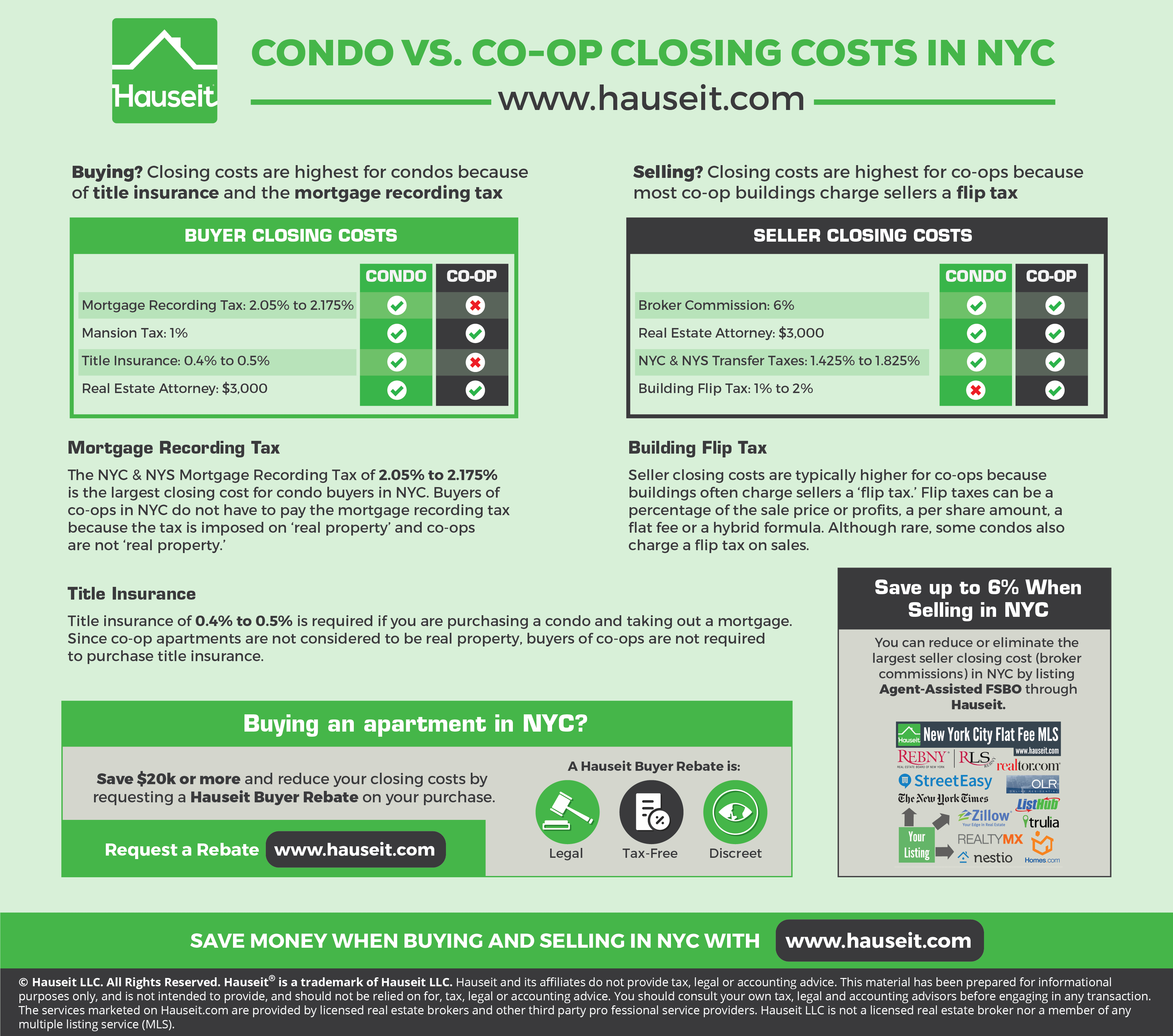

Buyer closing costsin NYC are lower for co-ops than condos because co-ops are not considered to be ‘real property.’ Condos have two additional buyer closing costs as a result of being considered real property (like houses and land). These additional closing costs are the NYC & NYS Mortgage Recording Tax as well as Title Insurance.

To estimate your buyer closing costs in New York City, visit Hauseit’s industry leading Closing Cost Calculator for Buyers in NYC: https://www.hauseit.com/closing-cost-calculator-for-buyer-nyc/

Mortgage Recording Tax

The NYC & NYS Mortgage Recording Tax of 2.05% to 2.175% is the largest closing cost for condo buyers in NYC. Buyers of co-ops in NYC do not have to pay the mortgage recording tax because the tax is imposed on ‘real property’ and co-ops are not ‘real property.’

Title Insurance

Title insurance is required if you are purchasing a condo and taking out a mortgage. Title insurance is a one-time fee of approximately 0.4% to 0.5% of the purchase price paid by the buyer at closing. Title insurance protects against principal loss and attorney fees in the event someone makes a claim against a condo’s title in the future.

Buyer closing costs for condos in NYC are approximately 2.5% to 3% higher than for comparable co-op apartments due to the mortgage recording tax and title insurance.

As a seller in NYC, closing costs are actually lower for condos compared to condos. This is because most co-op buildings charge sellers an additional closing fee called a ‘flip tax.’

Infographic Source: https://www.hauseit.com/closing-costs-co-op-vs-condo-nyc/

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal

What irks me the most is the concept of the ‘mansion’ tax. How exactly is a small 1 bedroom considered to be a mansion in New York City? I totally get the fact that NYC is cash strapped and that they’ve come to rely on the ‘mansion tax’ as a source of revenue. They should at least be forthright in their intentions though and call this something other than a mansion tax, since it actually applies to tiny apartments.

The term mansion tax may have been accurate in the 1980s, but it’s insulting to call it that now!

Hi Jackie – we certainly emphasize with you in feeling frustrated that buyers in 2018 have to pay a tax designed for buyers of mansions in 1989!

As we explain in the following article, $1 million in 1989 adjusted for inflation is equivalent to $2 million in today’s money: https://www.hauseit.com/nyc-mansion-tax/

The mansion tax has not been adjusted for real estate inflation since it was written into law.