A short-term loan is a loan scheduled to be repaid in less than a year. It’s actually paying less interest than the loan with longer duration. A short-term loan is taken to meet any uncertain expenditure.

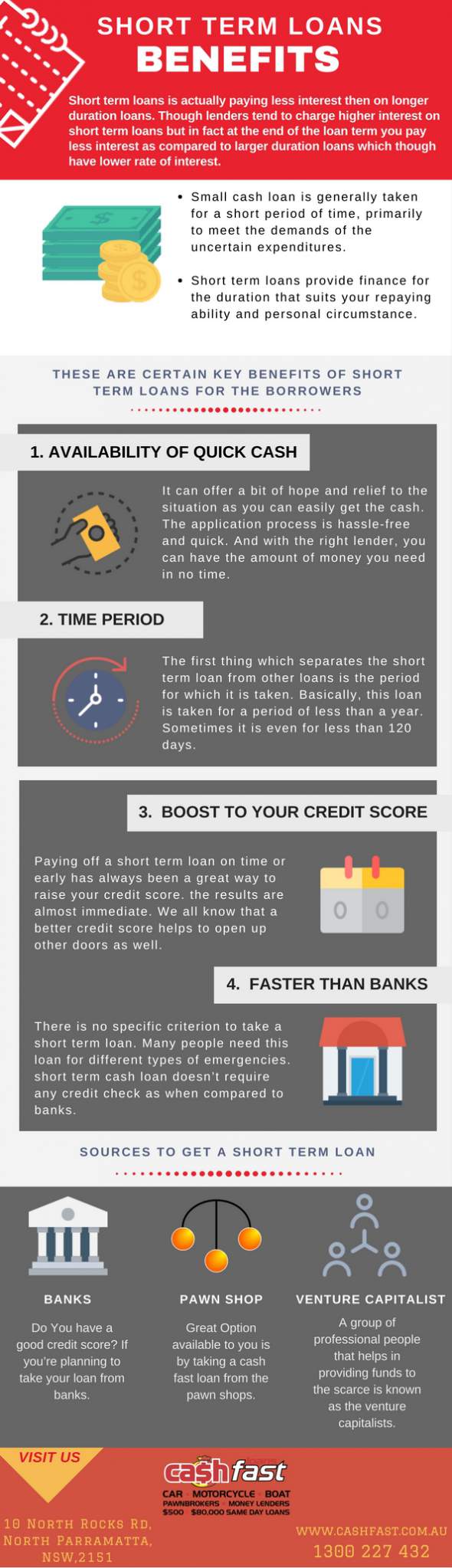

Here’s an infographic to make you understand the concept in a better way.

Benefits of taking a Short Term Loan:

- Time period

It is taken for less than a year.

- Means to Quick Cash

If you get an accurate lender, you can get your money instantly.

- Quicker than Banks

As there are no specific documents needed for taking a short-term loan, it operates faster than banks.

- Improve your Credit Score

Paying a short-term loan on time or before the time will help you boost your credit score.

Sources of taking a Short Term Loan

- Banks

A good credit will help you get a loan from the bank.

- Pawn shop

No credit history is necessary for taking a loan from a pawn shop.

- Venture Capitalist

It’s a group of experts that provides funds in the scarce situation.

Infographic Source : https://www.cashfast.com.au/4-benefits-of-taking-a-short-term-loan/