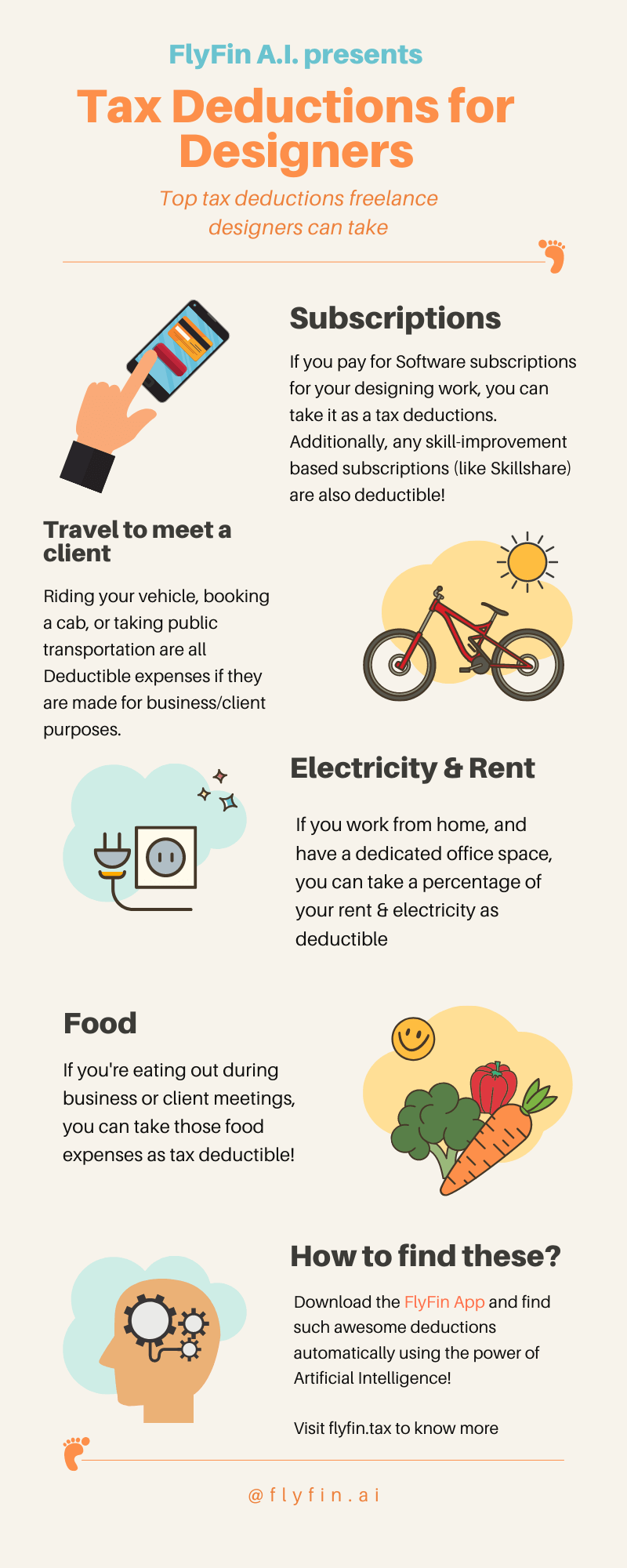

As a freelance designer, there are several deductions you can claim to lower your taxes, such as:

- Subscriptions: Any designing software subscription you require, such as Adobe Creative Cloud, is deductible.

- Travel: You can deduct all your business travel expenses, including transportation, lodging, and meal expenses.

- Electricity & Rent: If you work from home, you can deduct a portion of your electricity bill and rent.

- Food: Any meals you consume for business purposes while meeting potential clients is deductible.

As a designer, there are many other expenses you can claim. Use FlyFin (https://flyfin.tax) to find more deductions based on your profession.