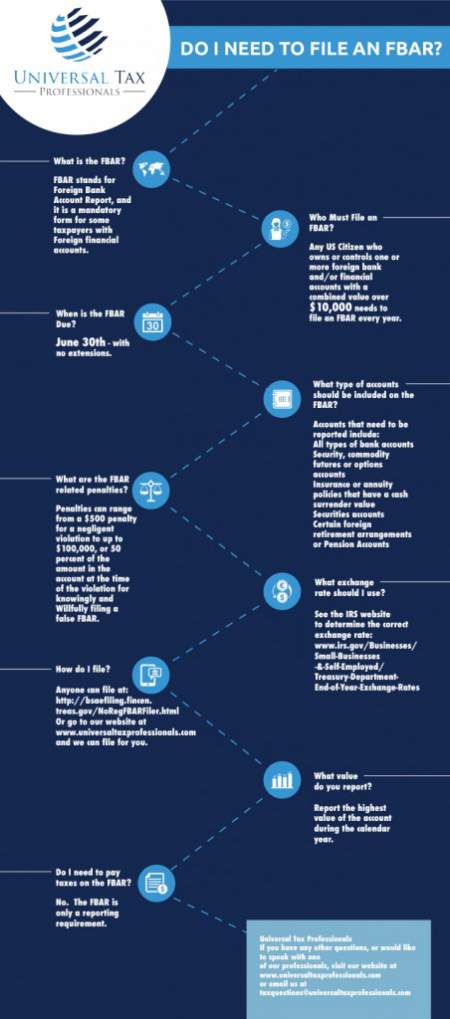

Do you need to file an FBAR. The Foreign Bank Account Report is a documents required of some American taxpayer who own or have signature authority over financial accounts overseas. The penalties for failure to file an FBAR can be great, so it is important to make sure to file this document if it is required of you. Other questions that this infographic covers include answers to questions such as how to file, what needs to be included and what exchange rate to use, and the due date.

Once a taxpayer determines that an FBAR is required, then there are two ways to file. The taxpayer can find a licensed tax professional, or the taxpayer can self file. To self file go to the BSA website and the FBAR can be submitted electronically. The FBAR is due on June 30th and there are no extension given in the current year. Next year the rules will change and the due date will be earlier and extensions will be allowed.

Do I need to file an FBAR?

November 25, 2015

A dedicated full-time digital marketer with 12+ years of experience in the industry. Since 2015, he has been successfully running infographicportal.com, a platform that showcases high-quality infographics across various topics. Nagendra's expertise lies in creating and executing effective digital marketing strategies that drive engagement and growth. His passion for visual storytelling and commitment to excellence has made him a respected figure in the digital marketing community.