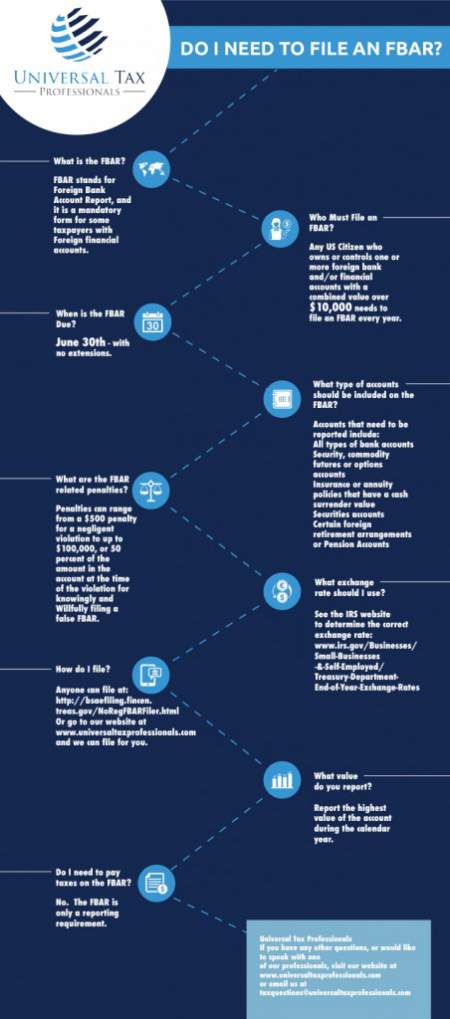

Do you need to file an FBAR. The Foreign Bank Account Report is a documents required of some American taxpayer who own or have signature authority over financial accounts overseas. The penalties for failure to file an FBAR can be great, so it is important to make sure to file this document if it is required of you. Other questions that this infographic covers include answers to questions such as how to file, what needs to be included and what exchange rate to use, and the due date.

Once a taxpayer determines that an FBAR is required, then there are two ways to file. The taxpayer can find a licensed tax professional, or the taxpayer can self file. To self file go to the BSA website and the FBAR can be submitted electronically. The FBAR is due on June 30th and there are no extension given in the current year. Next year the rules will change and the due date will be earlier and extensions will be allowed.

Tags American FBAR Foreign Bank Account Report taxpayer

Check Also

Top-10 Purposes to Take Small Loans

As of 2023, the US population is over 334 million. Did you know that every …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal