The question of whether the gig economy is just a fad is no longer relevant – it’s here, and work flexibility is now a reality for a major part of the US workforce. These days, skilled independent workers are in high demand.

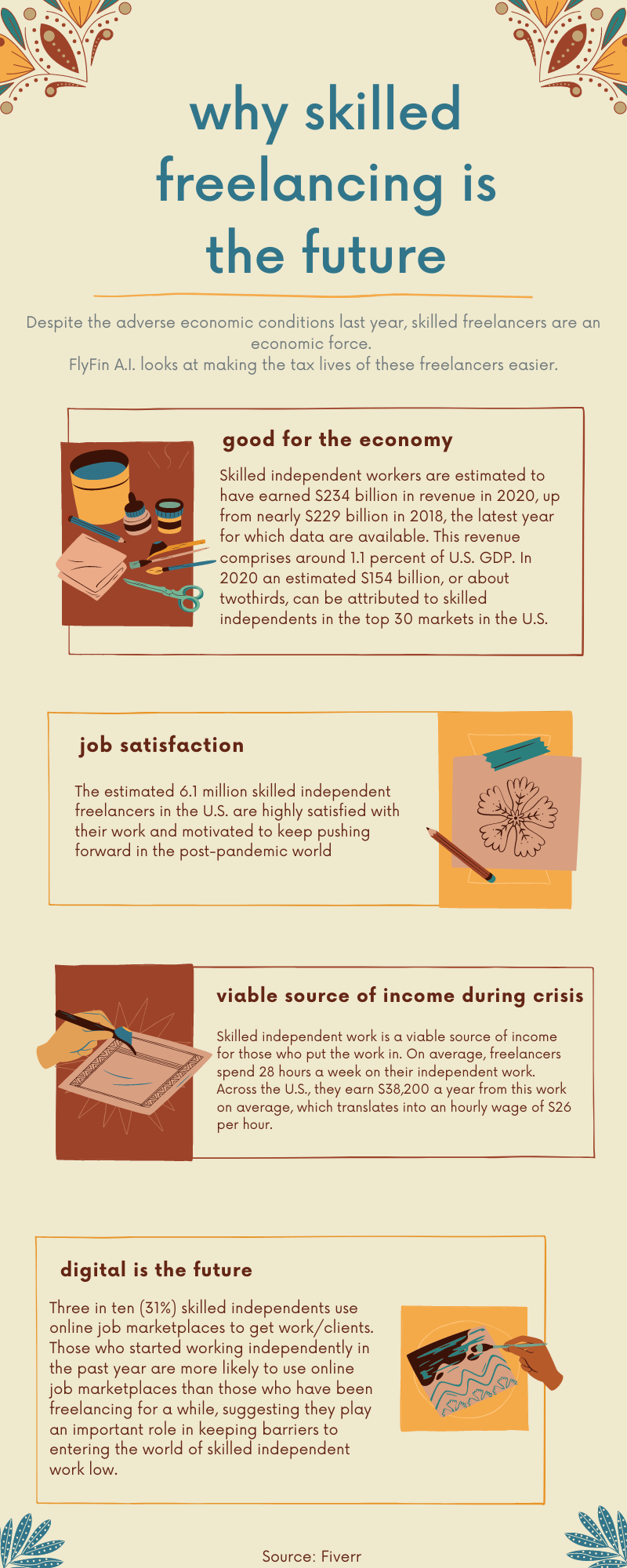

Skilled independent workers are estimated to have earned $234 billion in revenue in 2020 up from $299 billion in 2018. An estimated 6.1 million freelancers in the US are highly satisfied with their work.

Skilled independent work is a viable source of income for those who put the work in. On average, freelancers spend 28 hours a week on their independent work. It has been found that 3 in 10 skilled independent workers use online job marketplace to get work.

Considering last year’s pandemic situation, freelancing as a career choice has grown tremendously.

However, freelancing can be challenging, one such challenge involves paying estimated taxes. There seems to be quite a lot of confusion with regards to the taxes meant for the self-employed. Here, FlyFin helps bridge the gap between freelancers and the tax policies set by the IRS by making the entire process simple and efficient.

Infographic Source: https://flyfin.tax

Why Skilled Freelance is the Future

September 9, 2021

A dedicated full-time digital marketer with 12+ years of experience in the industry. Since 2015, he has been successfully running infographicportal.com, a platform that showcases high-quality infographics across various topics. Nagendra's expertise lies in creating and executing effective digital marketing strategies that drive engagement and growth. His passion for visual storytelling and commitment to excellence has made him a respected figure in the digital marketing community.