The question of whether the gig economy is just a fad is no longer relevant – it’s here, and work flexibility is now a reality for a major part of the US workforce. These days, skilled independent workers are in high demand.

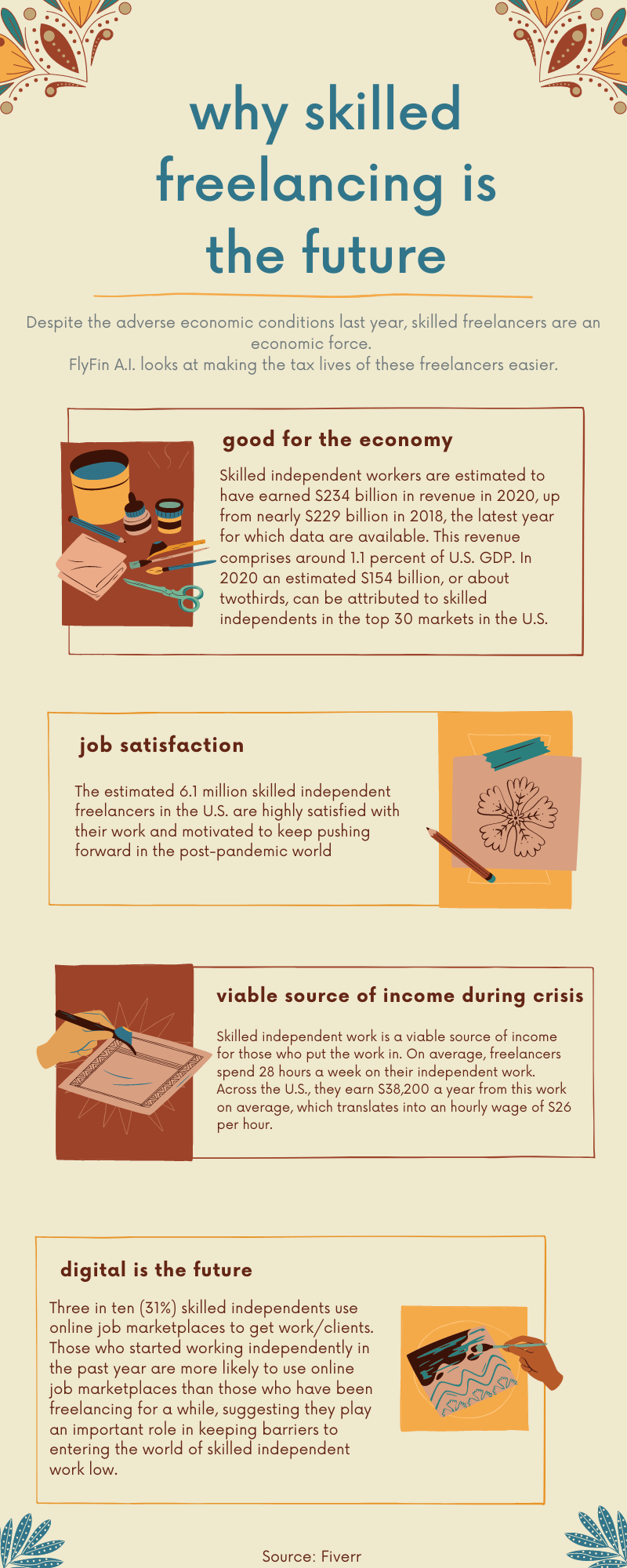

Skilled independent workers are estimated to have earned $234 billion in revenue in 2020 up from $299 billion in 2018. An estimated 6.1 million freelancers in the US are highly satisfied with their work.

Skilled independent work is a viable source of income for those who put the work in. On average, freelancers spend 28 hours a week on their independent work. It has been found that 3 in 10 skilled independent workers use online job marketplace to get work.

Considering last year’s pandemic situation, freelancing as a career choice has grown tremendously.

However, freelancing can be challenging, one such challenge involves paying estimated taxes. There seems to be quite a lot of confusion with regards to the taxes meant for the self-employed. Here, FlyFin helps bridge the gap between freelancers and the tax policies set by the IRS by making the entire process simple and efficient.

Infographic Source: https://flyfin.tax

Tags Future Skilled Freelance Why

Check Also

Business Analytics Jobs – Expected Salary Ranges in 2023

Get up to date with the latest salary information for Business Analytics jobs. The data …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal