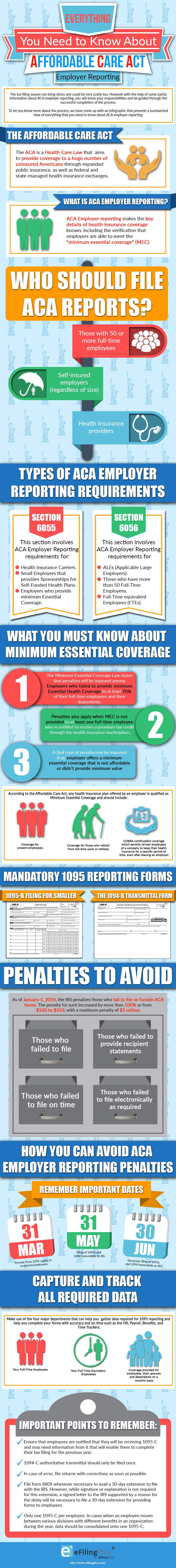

Affordable Care Act or ACA is one of the new tax forms signed in March 2010 and was supported as a law by the Supreme Court in 2012. ACA reporting is a form that focuses on the US’s healthcare system. One of the main objectives is to provide coverage to a large number of uninsured Americans through expanded public insurance and federal and state-managed health insurance exchanges.

Starting January, certain employers are now mandated to file the annual information return to the IRS along with a summary statement in accordance with the ACA Employer Shared Responsibility Provision. Employers who are required to file the ACA form are those with 50 or more full-time employees, self-insure employers and health insurance providers.

To know more about the Affordable Care Act and its reporting, here’s an infographic by eFiling Plus, one of the leading and trusted 1099 and W2 e-filing services in America.

Infographic Source: http://www.efilingplus.com/a-complete-guide-to-aca-employer-reporting/

Tags ACA Complete Employer Guide Reporting

Check Also

Top-10 Purposes to Take Small Loans

As of 2023, the US population is over 334 million. Did you know that every …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal