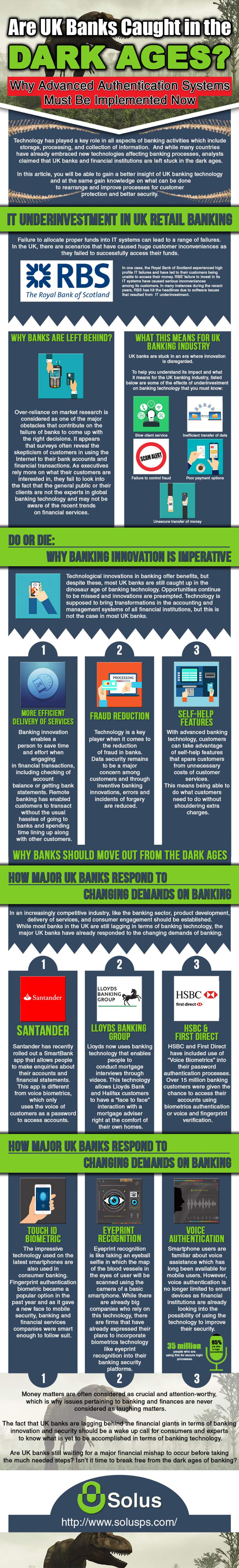

Technological innovations brought tremendous changes in banking. But while there are already lots of Europe and US banks that are using innovative systems when it comes to storage, processing, and collection of information, analysts claim that UK banks and financial institutions are still left stuck in the dark ages.

UK banks trail in terms of real-time internet-based cheque clearance and bank reconciliation services, thus compromising the convenience and security of banking processes.

Old age banking can bring security problems and at this point when threats to security are persistent and attacks can happen anytime, UK banks pose higher risks for consumers.

Banking innovation is imperative at this point and while major UK banks already revealed plans to innovate their banking technology, the question still remains as to whether other UK banks will follow and keep up with recent innovations.

To provide further information regarding the state of UK banking technology, we have come up with an infographic that presents important facts and useful data to show the state of banking in the UK.

Tags Caught Dark Ages UK Banks

Check Also

Must Use Ai Tools In 2024

As we venture further into 2024, the importance of leveraging AI tools to enhance productivity, …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal