Bad credit is limiting in many areas of life and it is worthwhile to work hard to improve your credit score if it is bad or to maintain a good credit score if you have one. Unfortunately, many youngsters, such as students, create a bad credit score for themselves at a time when they are more concerned with having fun than with their financial situation and this comes back to haunt them later on.

Other people have bad credit due to bad planning or difficult circumstances. Whatever the reason for the bad credit, there are ways to improve your credit score, but they are hard work. One of the ways that having bad credit will have a negative impact on you is when it comes to applying for a personal loan and here, we will look at what happens if you have bad credit and need a loan.

Bad Credit Loans

If you need a loan, but have bad credit, you will need to find a lender that offers credit for bad credit. Many lenders, particularly traditional lenders such as banks, will require a credit check as part of the application process and anyone with bad credit will be rejected.

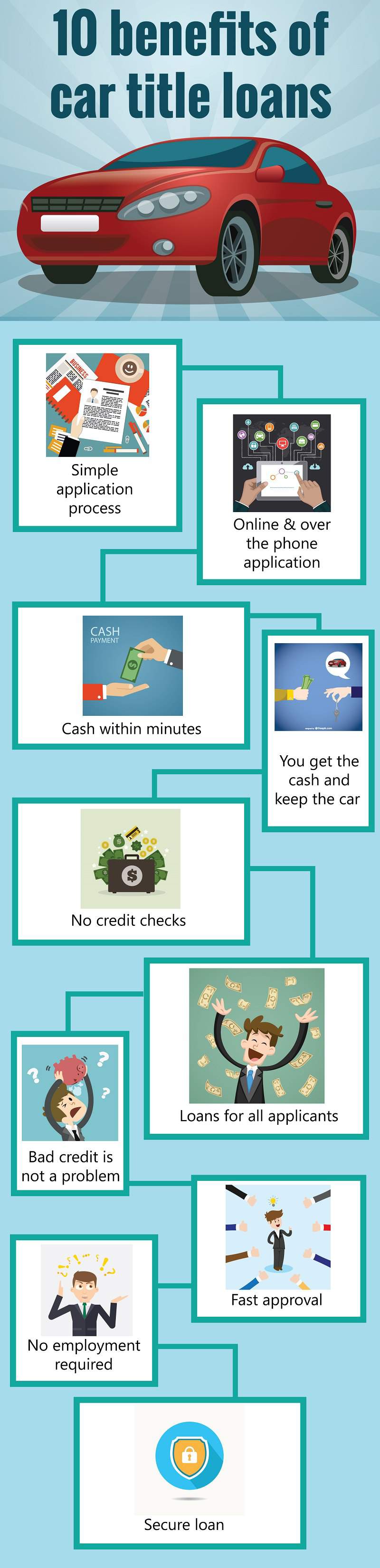

A lender that does not require a credit check during the application process will have loans available for bad credit borrowers. Examples of these types of loans include car title loans and payday loans. While these are not traditional types of loans, they offer flexibility making them an option for people who would otherwise be rejected for a personal loan.

- Car Title Loans – These are secured personal loans that use your car as collateral. In order to be eligible for these loans, you must have a car with a valid title and insurance and be resident in the area. The lender becomes the lienholder for the life of the loan and the loan amount is based on the current market value of the car. You are required to repay the loan within around 24 months and once the loan has been repaid, the lien moves back to you. The loan requirements are flexible and you can be eligible regardless of your credit score, employment status or source of income.

- Payday Loans – These are unsecured personal loan. To be eligible for the loan, you must have regular employment as the loan amount is based on the size of your paycheck. They are short term loans and are required to be paid back when your next paycheck arrives. The loan requirements are flexible and there is no credit check making them suitable for people who have bad credit or no credit score; however, the interest rates are very high.

Taking a Loan with Bad Credit

Before you take a loan with bad credit, make sure you will manage the monthly repayments. If the interest rates and repayment conditions will make the loan too difficult to repay, it will just make your credit score worse, creating a more difficult financial situation for you in the long term.

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal