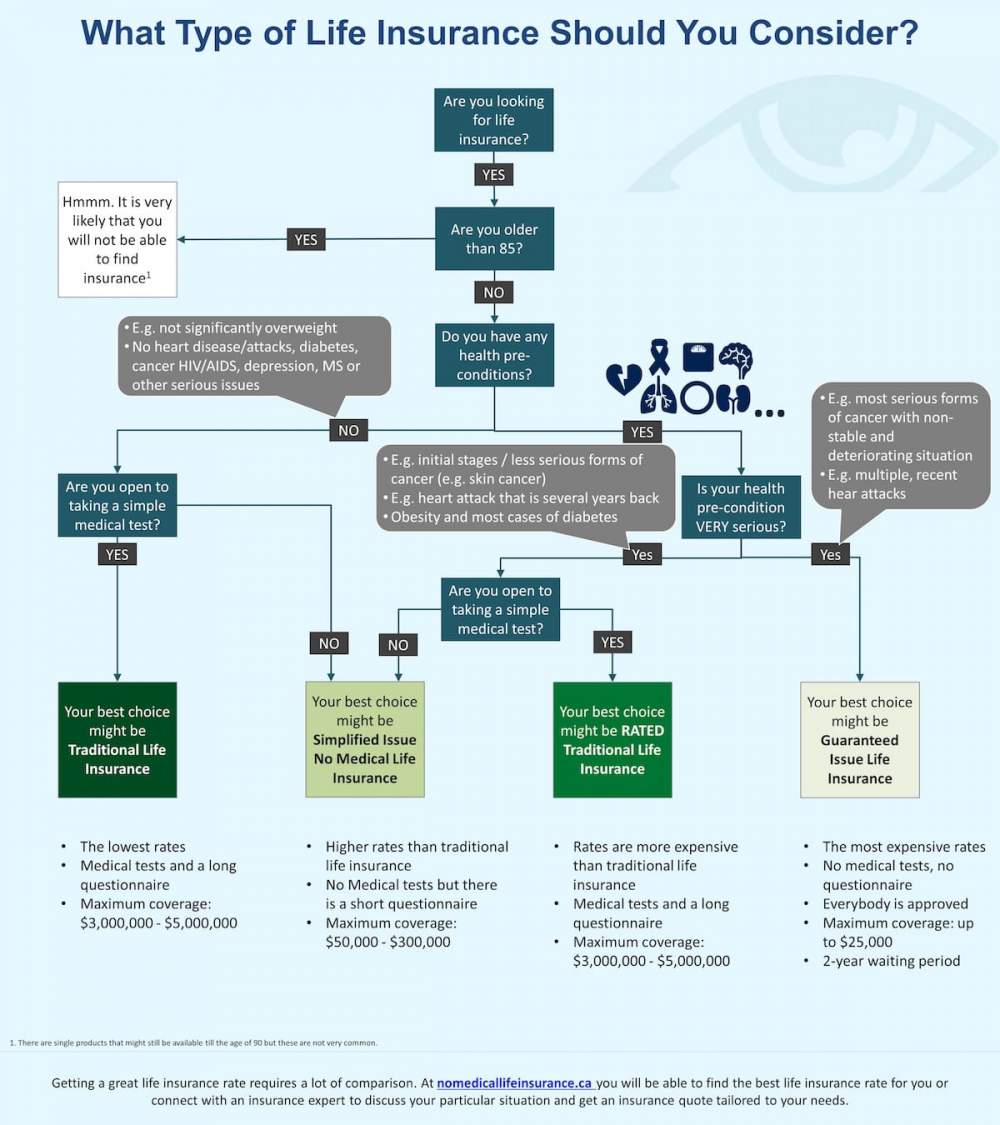

When it comes to buying a life insurance policy, one faces a dilemma: what policy to choose from? There are, indeed, plenty different life coverage policies. However, typically they all can be split into four main types, that is Traditional Life Insurance (or Standard Life Insurance), Rated Traditional Life Insurance (or Rated Standard Life Insurance), Simplified Issue No Medical Life Insurance, Guaranteed Issue No Medical Life Insurance.

Here these policies are listed in order of increasing risks. But what are those risks?

Every insurance policy, whether it’s life insurance or car insurance, has some risks, and insurance companies know about this the best of all. Talking about life protection, these risks are mainly related to three major factors: health, age, and habits.

It is quite obvious that your health condition is crucial in choosing a coverage. A healthy person will get a policy with a significantly lower rates, than a person with existing pre-condition. Same goes for age – older people have to pay a bit more for an insurance, so it is a common practice to buy a life insurance while you are still young. And if you are a smoker, for example, your rates will jump high, comparing to the person leading a healthy lifestyle.

This infographic provided by No Medical Life Insurance features typical scenarios for all four types of life protection mentioned above. Although this infographic shows scenarios that usually take place in insurance decision, but there are exceptions as every case is unique.

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal