With the increasing competition in the market today, small- and medium-sized businesses need to take advantage of every strategy that will enable them to have better control over their financial situation.

One of the sectors that small businesses can save a great deal of money these days is a commercial lease and rental space. Whether you need an additional storage room or anew location for your retail store, entering a commercial lease contract could be one of the wisest financial decision you’ll ever make.

The statistics from previous year tells us the increasing trend of commercial leasing in the business landscape. The 2017 North America, U.K., and Germany commercial real estate report forecast indicates a positive outlook on commercial leasing sector:

- Another year of solid job growth was reflected in strong U.S. office fundamentals as 2016 ended with a 12.4% vacancy rate, a slight improvement compared with year-end 2015.

- There was 95 msf under construction at year-end 2016 – up 8% year-over-year – of which 52% was pre-released. Three cities, New York, Washington, DC, and Dallas, together accounted for 40% of all new construction in the U.S.

- The U.S. industrial sector registered further improvement in 2016, ending the year with 5.7% vacancy.

- In total, 166 msf of industrial rental space is under construction compared with 147 MSF one year ago. 60% is concentrated in five key U.S. markets, each of them having more than 17 MSF underway: Los Angeles, Chicago, Philadelphia, Atlanta, and Dallas.

What is Commercial Leasing?

For the uninitiated, a commercial lease is a contract between a landlord and a business for the rental of property. The primary reason why most businesses will choose to rent a property instead of buying it is that it requires less capital. Compared to typical residential lease, a commercial lease contract is much more complex, and the terms vary greatly from lease to lease.

Benefits of Commercial Leasing

Before signing any long-term contract, it is important to understand the benefits it can bring to the table. Fortunately, when it comes to the benefits of commercial leasing, it is easy to see why this is asmart choice for small- and medium-sized businesses.

Payments

One of the best parts of a lease is the flexibility of payment terms. If you don’t have enough capital, purchasing a commercial real estate may require you take a hefty loan from your bank. When you fail to repay this loan, you not only risk your business operations, but also the property itself, which can leave you in a difficult situation.

On the other hand, a commercial lease allows you to make smaller payments over a longer period of time, giving you the breathing room that you need to keep your company healthy.

Responsiveness

Finally, when you choose a commercial lease, you are making a decision to engage your company more directly in the increasing competition in the market. You’ll never be tied down to one location, allowing clients, meaning that you won’t have to keep paying off a loan for a property that is no longer in a strategic position beneficial to your business.

There is a lot more to benefit in a commercial lease–some of them quantifiable, some of them big picture. However, in order to realize these potentials, make sure that you clarify all the major issues that are of equal importance for you and the landlord.

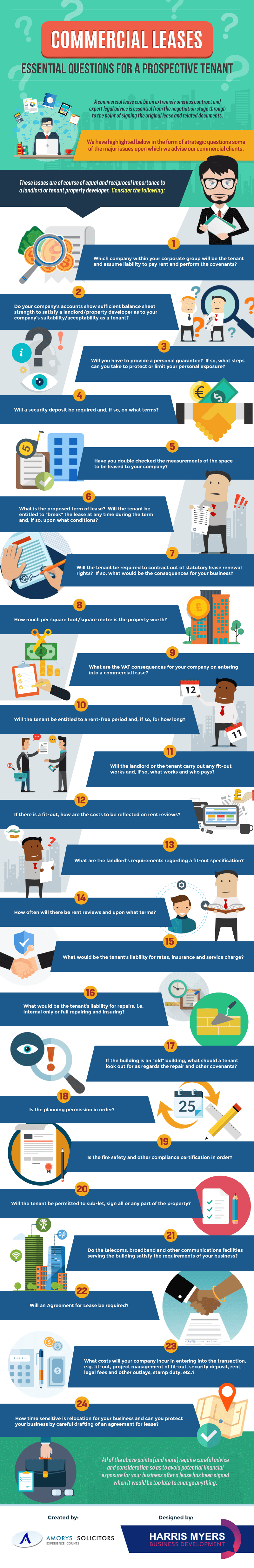

If you are planning to enter a commercial lease contract soon, then check the infographic below from Amorys Solicitors to know the essential questions that every tenant should ask before leasing a commercial property.

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal