Marketing and trade platforms have become well established through e-commerce sites. Consumers are also getting a better opportunity for viewing a variety of products at one’s leisure. The process of purchasing has also become quite easy as online portals are there to handle payments and the goods are also delivered in a suitable manner within a given time frame. This huge popularity of online business sites has urged more business owners to form e-commerce sites for their business, and if marketed properly then e-commerce sites have a huge chance of growing the clientele of a business.

The causes of the capital problems that can shake the foundation of a business

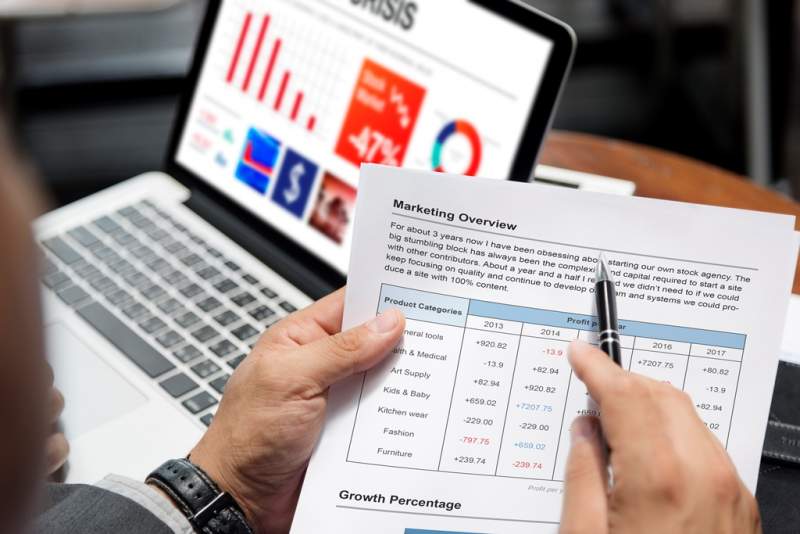

In many cases, it has been observed that the business foundation is suffering from the low inflow of capital or periodic losses have crippled the business economy to a huge extent. In such cases, it is important to identify the causes of the problems and then take suitable action. Identification is at the heart of rooting out problems from the foundation hence as a business owner one must be aware of the financial problems that can crop up in the business organization and he/she should be able to isolate the causes correctly. Some of the well-known causes that hamper the economic structure of the business includes the following:

- The decline in the production of goods: When a person is selling a particular kind of goods, then it is important to manufacture those goods in a steady manner. If the production fails, then there will be nothing to offer to the customers. Customers often visit a site for making purchases, but if the products are marked as unavailable for a long period of time then gradually the most faithful customer will also walk away and find the same kind of product from other online shopping sites. Hence it is very important to keep the production of the gods functional and fast because less production means dissatisfied customers and hence less earning. The lower the number of sales due to lack of products the higher is the number of customers lost for the same reason. The situation will inadvertently cause financial problems in the business enterprise if the production is not enhanced.

- Lack of product awareness or brand promotion: As a business owner, promotional activities require the investment of money but if the brand is not promoted then the people will not be acquainted with the products or business brand, and hence sales target cannot be achieved in any manner. Lack of sales will definitely decrease the inflow of money which will adversely affect the business economy.

- The improper allocation of financial resources: In business, money has to be used for many purposes and for each purpose a definite amount is needed. However, all these purposes are not of equal importance, and so money has to be allocated to a priority-based approach. The most important task should be given priority while the least urgent task should be given less priority. Money should always be spent in a measured manner, and its utilization should be observed at every stage because otherwise, improper expenditure will lead to a financial crisis.

The factors that play an essential role in handling business debts

Due to unfortunate scenarios debt can form in a business economy. In simple terms, debts are loans that have not been paid on time. For managing debts, one can take help of the services offered by https://www.nationaldebtrelief.com/but if a business owner wants to solve the debts single-handedly then knowing the different aspects of debt solving techniques is of paramount importance. Some of these factors are enlisted below:

- The knowledge about the different avenues from where money has been taken: If there is a single debt, then it clearly implies that the borrower has made defaults in the payment of a particular loan. But as the borrower looking only at the debt is not enough he/she has to focus on all the borrowed sums which have been taken from various sources. If money has been taken on credit from more than one source then listing down all the credit sources becomes all the more important. Each credit source will require the payment of a certain sum of money which is also known as the minimum amount for preventing the amount from becoming a debt, and there will be another amount which will be total amount for solving the loan completely. As a business owner, it is very important to measure the financial position with respect to the dues which have to be paid. If the calculations are clearly done, then it will be easier to plan loan repayment and prevent further debt formation.

- Calculating the total amount of financial resources present for solving debts: In order to pay debts, one cannot simply look at the future financial gains of the business enterprise. It is true that profit can help in solving loans, but that doesn’t imply that the business owner will be wholly dependent on profit for solving the loan or debt. The business person has to look for sources from where money can be withdrawn for solving the debt as quickly as possible. Minimum payments only prolong the duration of the debt, and it takes a very long time if only minimum amounts are paid. Therefore, if it is possible to close the debt fully by making a single payment, then that should be done instead of making small payments for a prolonged period of time. The debt can be repaid quickly by breaking an investment or from any other source. A person can calculate the interest paid on the debt and compare it with interest received on the investment. If the later is low, then it is sensible to break the investment and solve the debt.

Hence, it is very important to market the business properly, but it is also equally important to take stock of financial matter sand use financial tools in a sensible manner.

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal

I think this would be an eye-opening post for the entrepreneurs. We all know about the importance of managing, Settling the financial condition in business. Also, we need to know how to settle down our Debt loan, and what type of strategies available to do this, like Debt Consolidation. Debt Consolidation is the best way for Debt settlement. There are many facilities provided by Debt Consolidation. Thank you for sharing this.