Owning a credit card is advantageous on so many levels. You can get cash backs, earn reward points, build credit for future loans, conveniently pay for online shopping, and get a grace period when paying for your purchases or bills. For these reasons, more people are using credit cards to complete their transactions instead of the traditional cash payment method.

However, owning a credit card also entails some risks. If you can’t pay your credit card bill on time, your interest fees can accumulate into a large sum. Similarly, credit card fraud is a prevalent issue and, if you are not aware, can make you a victim of credit card scams.

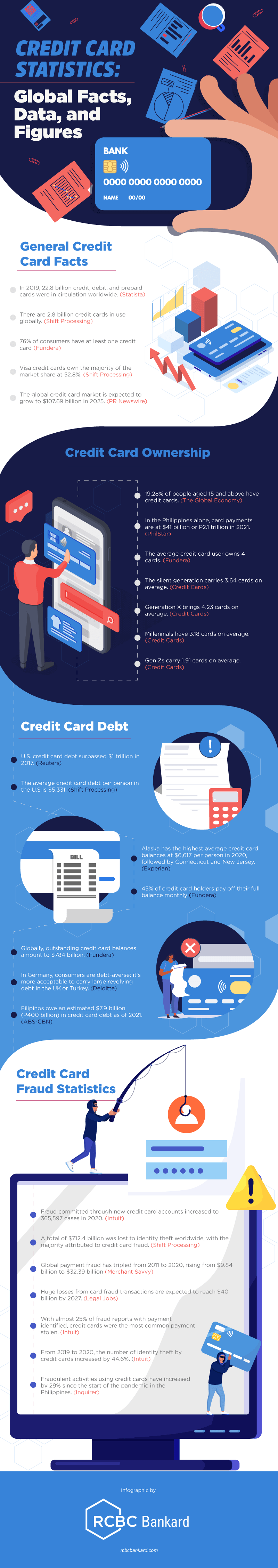

Thus, it is crucial to be aware of credit card statistics to be mindful of the possible debt and fraud that may occur with credit card use. These stats highlight the significance of tracking your purchases and how much money you’ve spent. You will also learn how you can leverage the benefits of your credit card and use it as a financial tool to invest and earn rewards.

Read this article for global facts, data, and figures on credit card ownership and usage.

Infographic Source: https://rcbcbankard.com/blogs/credit-card-statistics-global-facts-data-and-figures-16

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal