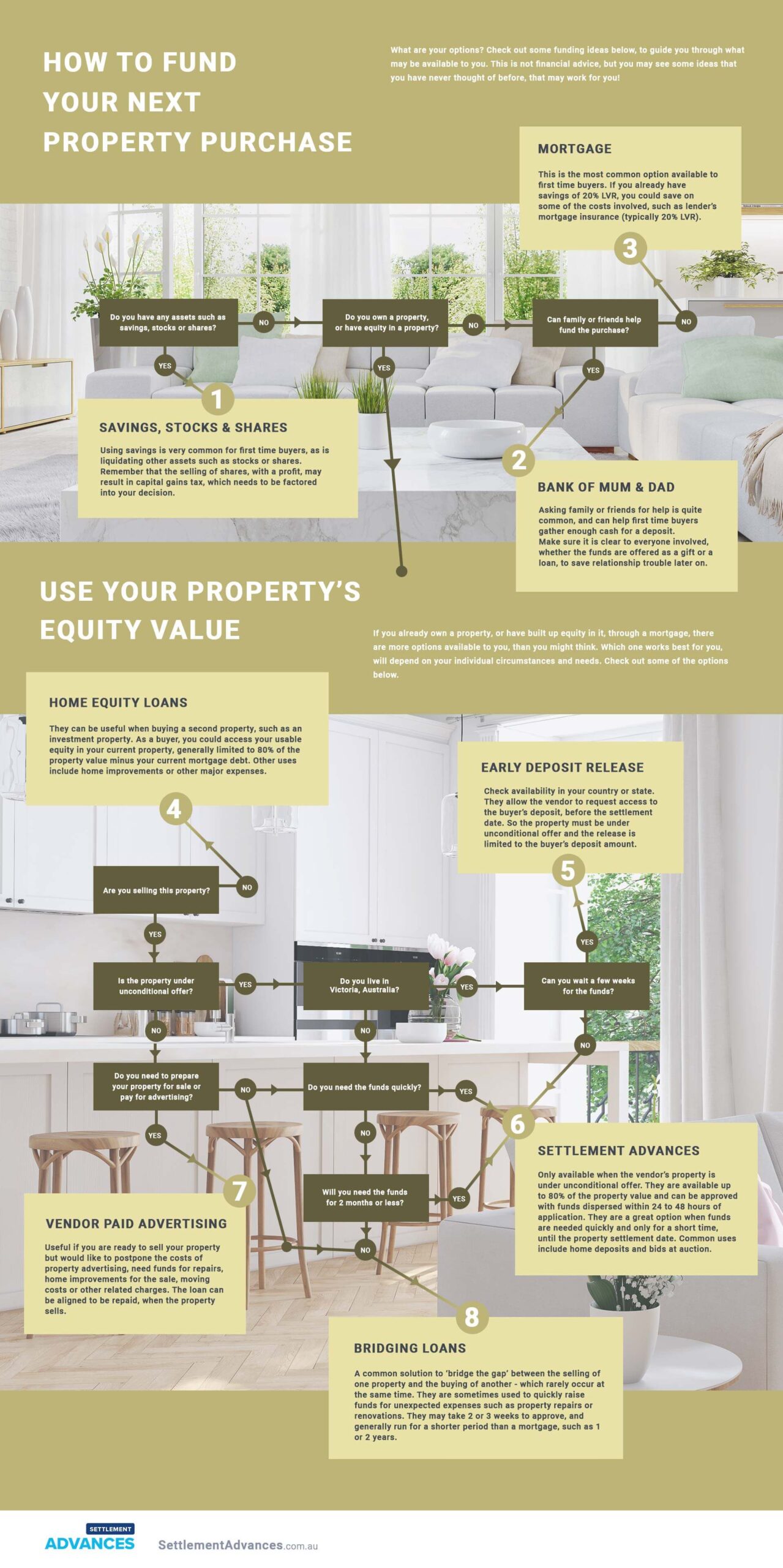

If you are a first-time home buyer in Australia, there are several options available to help finance your purchase. One option is to seek assistance from family and friends, known as the “”Bank of Mum and Dad””. It is important to understand the terms and conditions of this arrangement and to seek professional advice from a financial advisor or solicitor to ensure that it is structured fairly and in the best interests of all parties involved.

The most common option for financing a home purchase is to obtain a mortgage, however, if the deposit is less than 20% there may be additional costs involved, such as Lenders Mortgage Insurance (LMI).

For those who already own a property, the options available will depend on whether you are selling your current property or looking to purchase a second home or investment property. A home equity loan can be a useful tool for buying a second home, as it allows you to leverage the equity in your primary residence.

However, it is important to consider the risks involved, including the possibility of foreclosure, and to seek the advice of a financial advisor before applying. If your property is under an unconditional offer, you could consider early deposit release or a pre-settlement advance, or vendor-paid advertising if you need access to funds earlier in the selling process.

Another option is a bridging loan, which can help bridge the gap between the sale of one property and the purchase of another.

Infographic Source: https://www.settlementadvances.com.au/guides/property-funding-options.php

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal