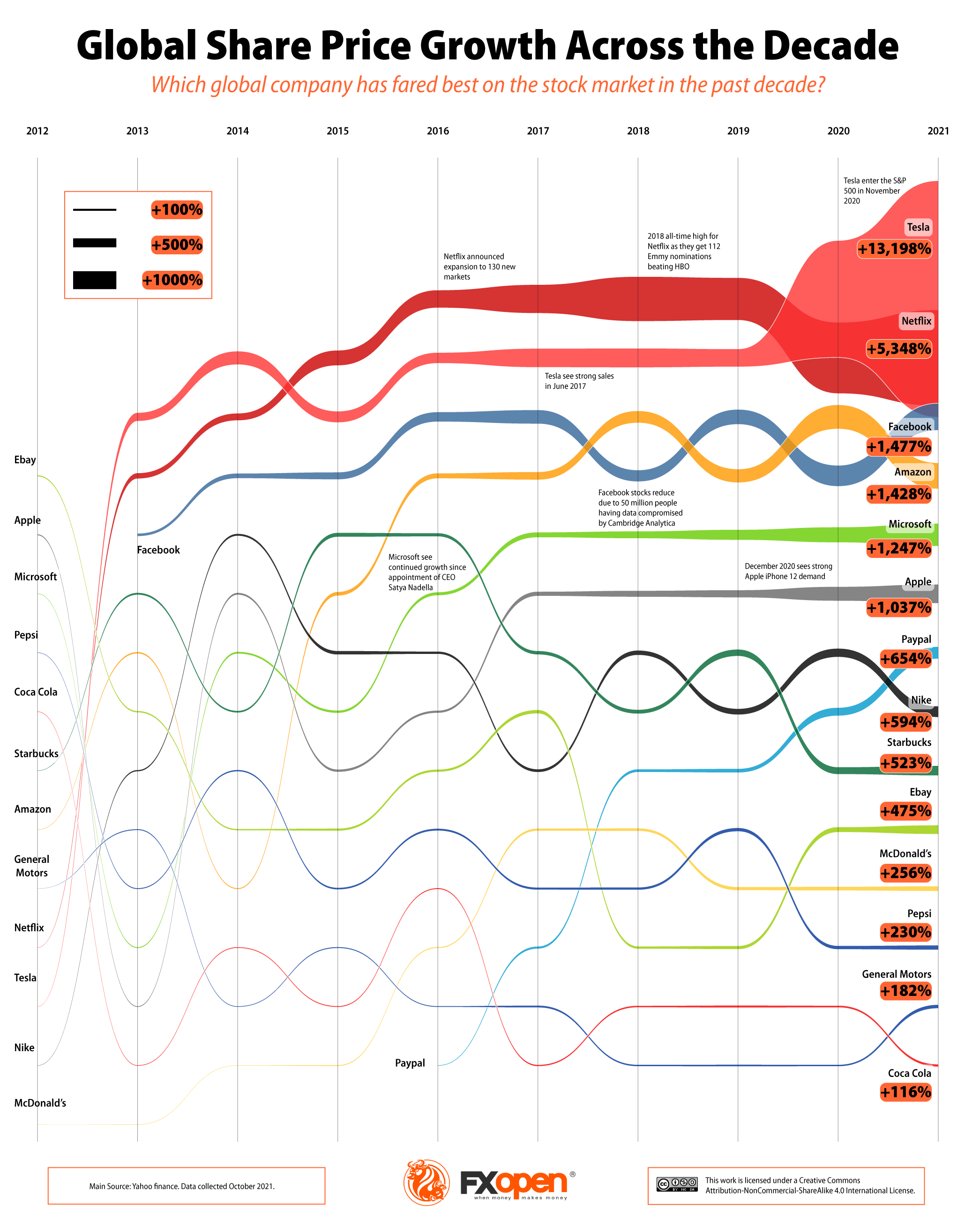

Tesla are in pole position in terms of share price growth across the past decade, according to new research from leading Forex brokers, FXOpen.

While Tesla started 2012 with an underwhelming 4% drop in their share price value, Elon Musk’s electric car company soon began to creep up the inside lane of the other companies in the study.

Reporting a 445% rise in 2013, Tesla managed to cross the finish line of the research in first place with a share price growth of 13,198% in 2021.

The automotive company has seen huge rises in their share price since 2019. October 1st 2019 their share price sat at $62.98, while the same period in 2021 it had risen to $780.59, again due to strong sales and the entering of the S&P 500 in November 2020.

General Motors, the only other motoring company involved in the study was lagging far behind with a final percentage growth figure of 182%.

Netflix was some way behind in second place, with the streaming giant recording a blockbuster growth percentage of 5,348% in 2021, putting their closest competitor Amazon into a supporting role with their own growth of 1,428%.

Due to international expansion in 2012 to Europe and a further 130 new markets in 2016, the subscription numbers have risen dramatically, with this year Netflix hitting 214 million subscribers, nearly ten times the subscribers they had in 2011.

Alongside global expansion, the streaming service started making their original content from 2012 which has been ever present in recent years and in 2012 for the first time they beat HBO as they received 112 Emmy nominations.

Netflix growth on the stock market dominated the other global companies we analysed, as it was the most successful company on the S&P 500 pre 2020. It has only been the past two years where Tesla share price growth levels have surpassed Netflix’s.

Facebook holds the status of being the company with the third highest growth in the study, posting a final growth figure of 1,428%, which won’t be liked by their closest competitor Twitter who actually saw a 4% reduction.

Facebook shares have seen consistent strong growth owing to the increase numbers of active users which sat at over 2.5bn people by the end of 2019 and the aggressive growth strategy through acquisitions such as Instagram in 2012 and WhatsApp in 2014.

The social media company has had some dips during their time on the stock market so far, in particular in 2018 when 50 million people had their data compromised by Cambridge Analytica.

Pepsi managed to pass the taste test, posting a 2021 share price growth percentage of 230%, almost double that of their rival Coca Cola (116%).

Over the past ten years, the share price of Pepsi-Co has increased by 230%. This is nearly double the 116% increase that Coca Cola has seen since 2011. Both brands had a similar yearly percentage increase in 2012 but since then, the Pepsi-Co share price has seen greater increases than Coca-Cola.

Infographic Source: https://www.fxopen.com/en-gb/news/global-share-price-growth-across-the-decade/

Tags Decade Global Share Price

Check Also

Top-10 Purposes to Take Small Loans

As of 2023, the US population is over 334 million. Did you know that every …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal