The IRS permits dancers to write off certain expenditures. To deduct an expense, it must be directly related to your profession, and it must be ordinary and necessary in the eyes of the IRS.

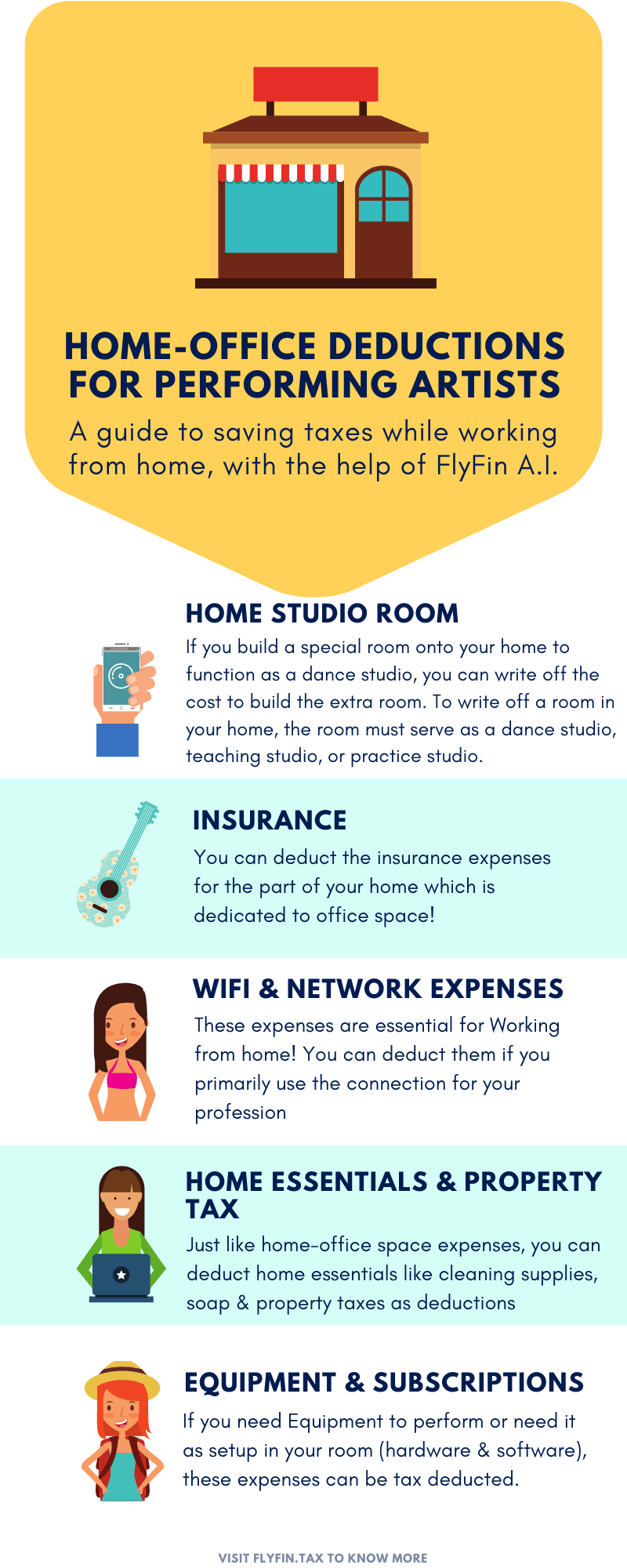

As a dancer or a performing artist, you are bound to require some space for teaching or practicing your routine. So, If you build a special room within your home to function as a dance studio, you can write off the cost to build the extra room. To write off a room in your home, the room must serve as a dance studio, teaching studio, or practice studio.

Now, when it comes to claiming the home studio, the IRS offers two methods to calculate the home office deduction- the regular method and the simplified method. The latter method is said to be easier but may result in a smaller tax break while the former option involves complicated calculations and recordkeeping, but can provide you with a larger deduction.

Choosing the ideal method can get tricky. To reduce your stress, you can try tax engines like- FlyFin. The app will assist you to perform the calculations and make the right decision for your home office. Moreover, the app is backed by CPAs whom you can consult to determine which method works best for you.

Infographic Source: https://flyfin.tax/blog/is-working-from-home-tax-deductible

Tags Deductions Home Office Performing Artists

Check Also

Top-10 Purposes to Take Small Loans

As of 2023, the US population is over 334 million. Did you know that every …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal