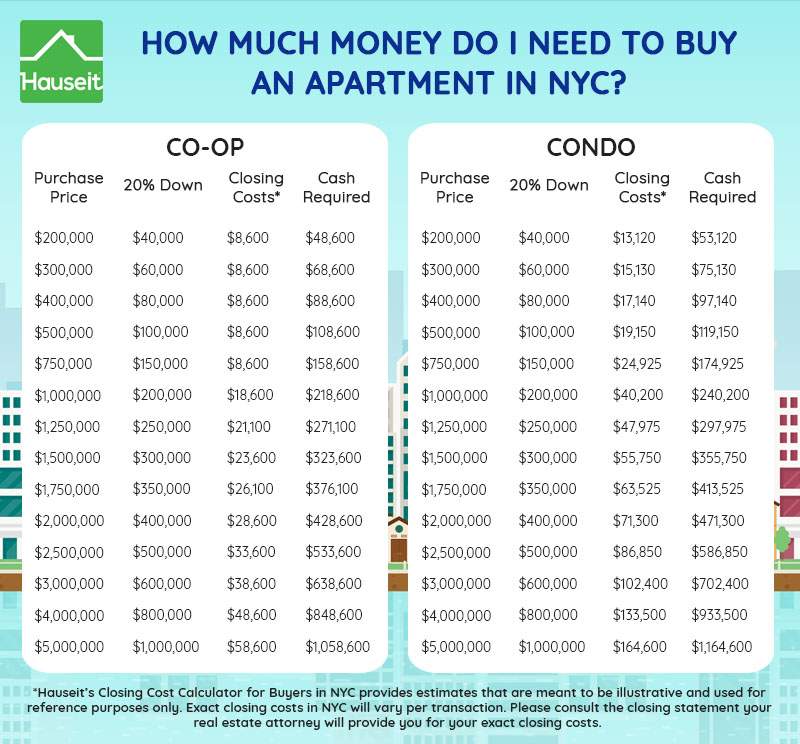

How much cash you need to buy an apartment in NYC depends on whether you are buying a co-op or condo, the size of your mortgage, and your desired down payment amount.

As a general rule of thumb, you need to have 21% to 22% of the purchase price in cash to buy a co-op (assuming 20% down) and 22% to 26% of the purchase price in cash if you’re buying a condo apartment in NYC.

These figures exclude bank reserve requirements, which are usually around 6 months of housing expenses. The figures above also exclude any post-closing liquidity requirements imposed by your apartment building, if you’re buying a co-op apartment.

Buyer closing costs for co-ops in NYC are approximately 1% to 2% of the sale price. Buyer closing costs for condos in NYC are roughly 2% to 6%. Condo buyer closing costs are as high as 6% for new construction and as low as 2% for an all cash purchase. The average condo closing cost bill for a buyer in NYC who is taking out a mortgage is 4%.

Toestimate your closing costs in NYC, visit Hauseit’s interactive buyer closing cost calculator.

Most banks and NYC co-ops will permit you to count liquid investments such as stocks, bonds and CDs towards theirpost-closing liquidity requirements. Whether or not a co-op will allow you to count retirement assets towards post-closing liquidity depends on the co-opboard.

You can save money on your purchase and reduce your buyer closing costs by requesting a Hauseit® Buyer Closing Credit. We’ve helped buyers in New York City save millions of dollars in closing costs since we opened our doors in 2014, and we’d love to help you too.

Infographic Source: https://www.hauseit.com/average-down-payment-apartment-nyc/

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal