Fraud, identity theft, money laundering, and data breach, among other illicit activities of criminals, continue to challenge financial firms. These crimes have a substantial impact on their reputation, which, in turn, can result in revenue loss and customer distrust.

To avoid such consequences, financial institutions employ identity verification processes before onboarding clients and authorizing transactions. Authentication methods allow organizations to determine if they are transacting with a legitimate customer. It also helps firms protect their clients’ funds and personal information, comply with regulations, and deter criminals’ fraudulent activities.

However, conventional identity verification solutions are inadequate in deterring fraudulent activities in this digital era, where many firms and customers shift to using digital channels for their transactions. Therefore, when implementing new remote verification processes, companies must replace outdated, manual checks with modern solutions, such as online identity verification, that are more efficient when onboarding customers and prohibiting the bad guys from accessing their systems.

Multifactor authentication solutions offer a more secure identity verification process as it involves the use of two or more verification criteria. Meanwhile, biometric identification solutions provide a less invasive and more reliable identity authentication process and support omnichannel customer identification.

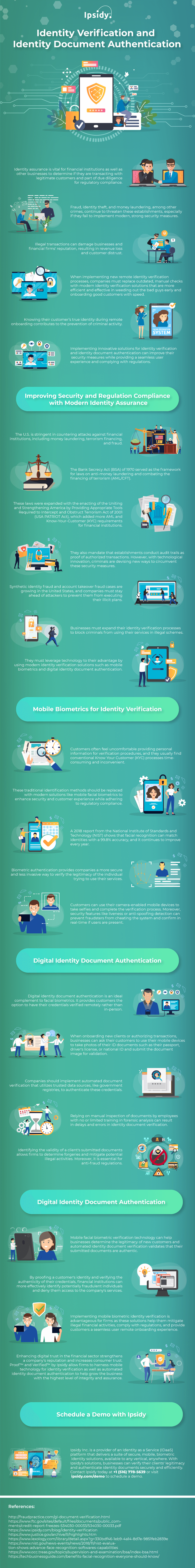

To improve security and regulation compliance, banking organizations need to implement innovative identity authentication solutions. Accordingly, enhancing digital verification processes strengthens an institution’s reputation and increases customer trust. This infographic from Ipsidy provides more details about identity verification and identity document authentication.

Infographic Source: https://www.ipsidy.com/blog/identity-verification-and-identity-document-authentication-infographic

Tags identity document authentication identity verification infographic

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal