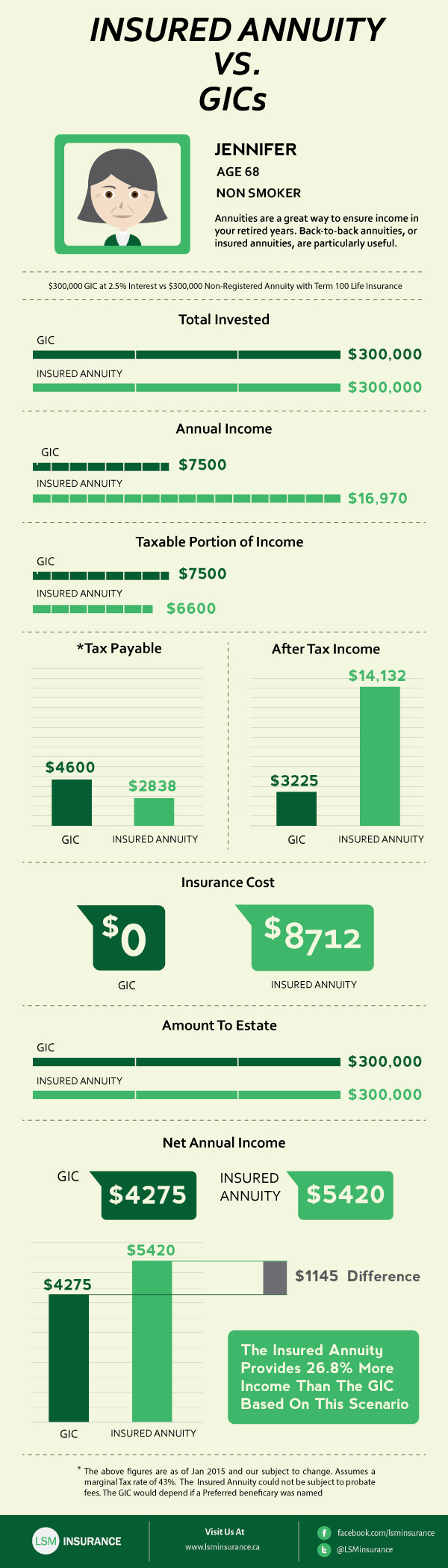

To ensure your income during your retired years, the best options would be investing into GIC and Insured Annuity. But which one is more suitable for you? Before diving into, let’s make sure we understand both terms.

GIC or as a guaranteed investment certificate, is an investment that offers a guaranteed rate of return over a period of time that is fixed. Most often, it’s banks or trust companies that provide GICs. GICs have a low risk profile, thus, the return from a GIC is generally less than other investments.

Insured annuity is basically a combination of term life insurance and a prescribed life annuity. The life annuity provides a guaranteed income stream and the term life insurance policy provides a cash payout upon a death claim.

To make sure you understand how the both work, we present you with infographic that features a scenario with Jennifer as our main character. If you don’t know in which option to invest, just check out how the income is generated in both cases.

Infographic source: https://lsminsurance.ca/life-insurance-canada/2015/04/insured-annuity-gic

Tags Annuity GIC Insured investment vs

Check Also

Top-10 Purposes to Take Small Loans

As of 2023, the US population is over 334 million. Did you know that every …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal