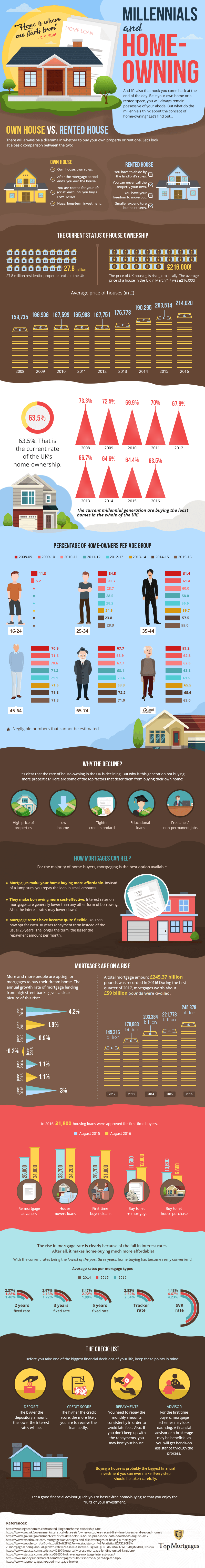

Buying your own home is one of the biggest decisions of anyone’s life and with house prices rising, unless you have £100,000 or more just lying around your bedroom, you’re likely going to have to take out a mortgage. Not only has the cost of home-owning increased, but the rate of homeownership has dropped dramatically. In 2008-09, it was found that 11.8% of 16-24 year olds were in the housing market and owned their own home. While in 2015-16, this number has dropped so dramatically that the figure was far too low for an estimate to be given. Due to the rise in housing prices, millennials are now choosing to rent or even stay at home with their parents in order to save money. While the homeownership of millennials has dropped significantly, there has been a slight increase in people aged 45-64, 65-74 & 75+ with homeowners per each age group having increased by 0.9%, 3.3% & 3.8% respectively. Further to this, mortgage totals have risen significantly over the last 4-5 years, with total mortgages amounting to £245.37 billion being recorded in 2016, compared to the £145.316 billion in 2012, showing that with the rise in housing prices, people are slowly being forced to take out mortgages if they ever want to achieve the goal of owning their own home.

So why aren’t millennials buying houses anymore? And will they ever start again?

Tags HomeOwnership Millenials

Check Also

The Essential House Turnover Checklist for New Home Owners

After years of hard work and dedication to saving money for your dream house, the …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal