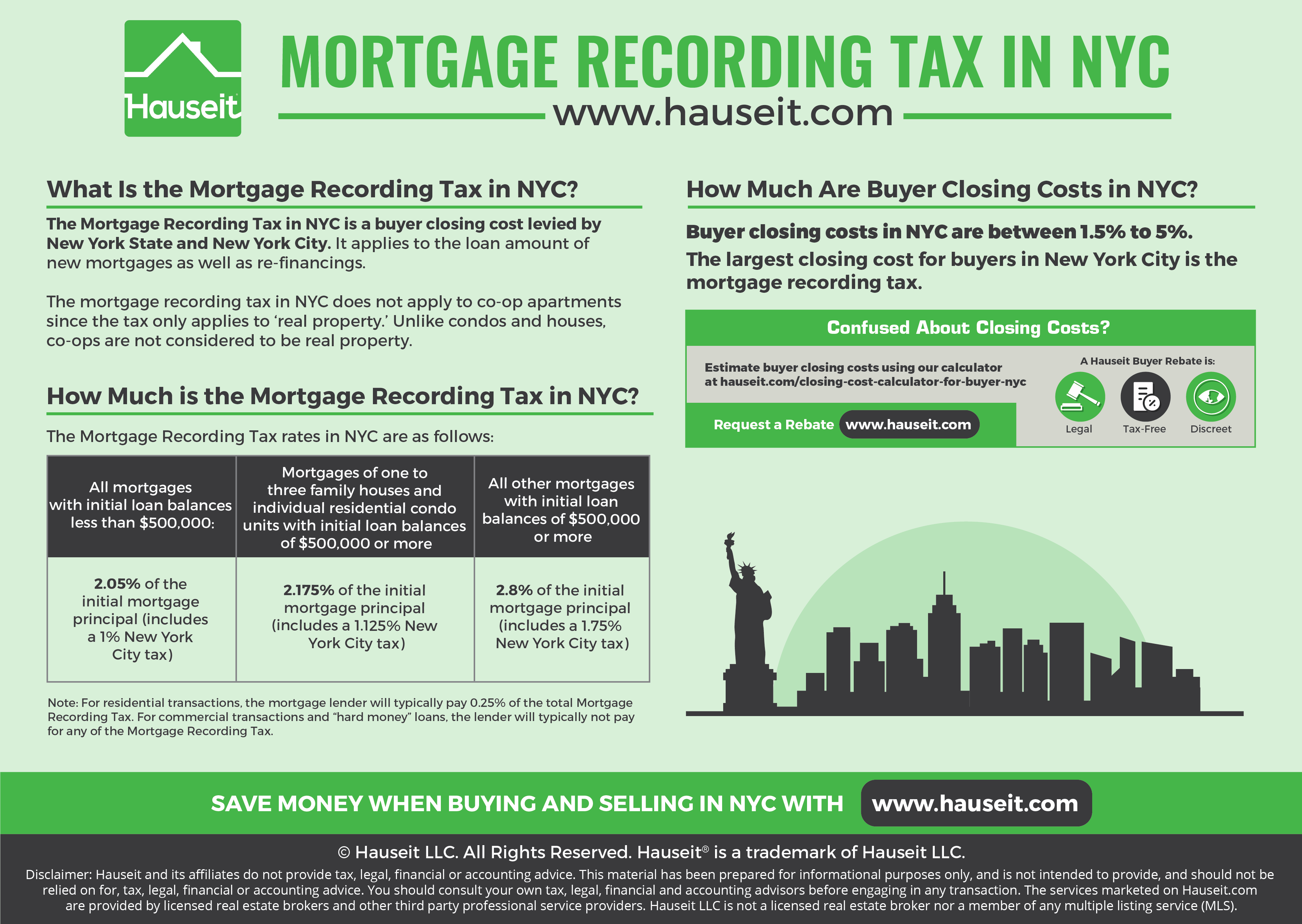

The Mortgage Recording Tax in NYC is a buyer closing cost levied on all new mortgages funded. The tax ranges from 2.05% to 2.80% and consists of both a New York City and New York State component. The Mortgage Recording Tax is paid by buyers.

The Mortgage Recording Tax Does Not Apply to Co-ops

The Mortgage Recording Tax in NYC only applies to ‘real property’ which means condos, townhouses, single family homes, multifamily properties, etc. Because co-ops are not considered to be real property, the mortgage recording tax does not apply to co-op apartments.

The fact that co-op apartments are not ‘real property’ is the main reason why buyer closing costs are lower for co-ops compared to condo apartments in New York City. In addition to being excluded from the mortgage recording tax, buyers of co-op apartments do not need to purchase title insurance. Title insurance, which is a one-time fee of 0.4% to 0.5% of the purchase price, is one of the largest closing costs for buyers in NYC.

To estimate your buyer closing costs in New York City, visit Hauseit’s industry leading Closing Cost Calculator for Buyers in NYC: https://www.hauseit.com/closing-cost-calculator-for-buyer-nyc/

Who Pays the Mortgage Recording Tax in NYC?

The Mortgage Recording Tax in NYC is typically paid by the buyer. For residential transactions, it’s common for the mortgage lender to pay 0.25% of the total Mortgage Recording Tax bill on behalf of the buyer.

Is It Possible to Reduce the Mortgage Recording Tax?

While there’s no way to avoid paying the Mortgage Recording Tax (MRT), you can offset this closing cost as a buyer and save money on your purchase by requesting a Hauseit Closing Cost Credit.

If the seller happens to have an existing mortgage, you can also reduce the Mortgage Recording Tax by negotiating a Purchase CEMA (Purchase Consolidation Extension Modification Agreement) with the seller.

Infographic Source: https://www.hauseit.com/mortgage-recording-tax-nyc/

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal

How can I find out if a seller has an existing mortgage? I’m interested in finding out more about the Purchase CEMA strategy for reducing the mortgage recording tax on a condo purchase in NYC.

Thank you.

Hi Carol,

The easiest way to find out whether a seller has an existing mortgage is to check in ACRIS which gives information about property ownership and records in NYC. Search for the address at the link below, and check to see if there are any documents titled “Mortgage” and/or “Satisfaction of Mortgage.”

Here is the link: https://a836-acris.nyc.gov/

Good luck!

Best,

Team Hauseit