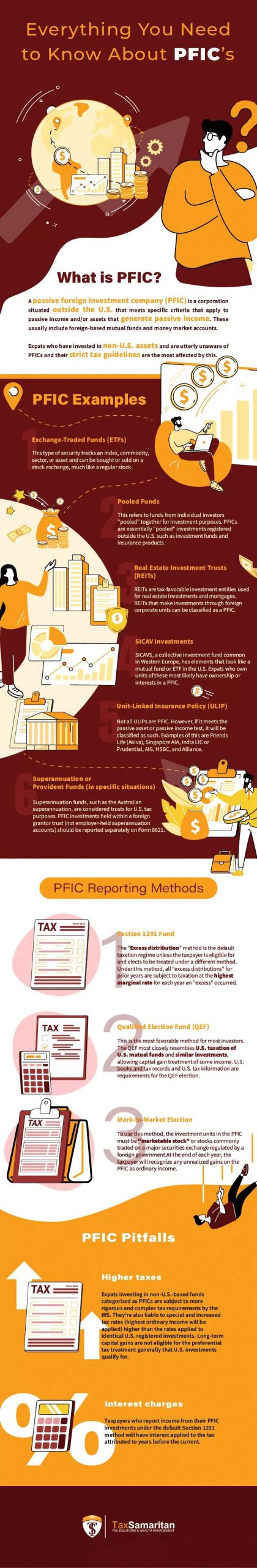

If you have investments outside of the United States, you must understand the tax obligations involved with them. Whether you’re an expat, a foreign national living in the U.S., or a U.S. resident who has foreign investments, learning about Passive Foreign Investment Companies (PFIC) can help you make wiser investment decisions and save money.

The Internal Revenue Service (IRS) taxes PFICs very differently from U.S.-based investments. It taxes foreign investment accounts at a high percentage that can even reach up to 50%. These foreign investments practically include all types of investments, from hedge funds to money market accounts and mutual funds to private equity funds.

The U.S. encourages its citizens to invest in U.S.-based investment products over foreign mutual funds, which is why the government created The Tax Reform Act of 1986. This legislation imposes many additional PFIC reporting requirements. The U.S. government also designed a complicated tax structure for PFICs so that U.S. citizens and Green Card Holders will feel burdened to invest in non-U.S. funds.

Because of the PFIC’s complex tax structure, many people are unaware of its taxation method. It’s best to understand everything there is to know about PFICs to help you avoid high taxes, hidden fees, and unexpected interest payments.

Here’s an infographic by Tax Samaritan to get you started.

Infographic Source: https://www.taxsamaritan.com/tax-article-blog/pfic-101-everything-you-need-to-know/

Tags 101 Companies Passive Foreign Income PFIC

Check Also

Top-10 Purposes to Take Small Loans

As of 2023, the US population is over 334 million. Did you know that every …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal