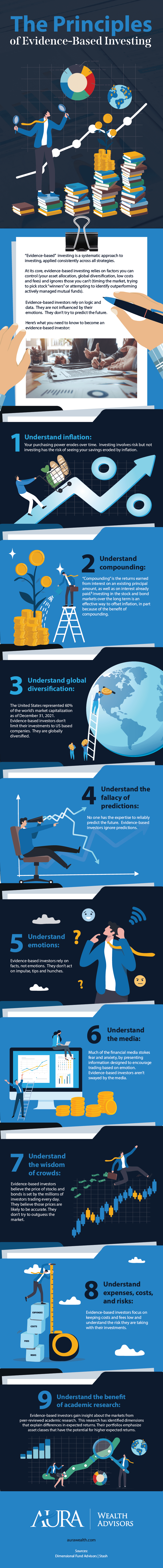

Evidence-based investing is a style that bases choices on the use of data-driven analysis and empirical evidence. The foundation of evidence-based investing is that investment decisions should support by objective, verifiable information, and data rather than relying on biased opinions or subjective judgments.

Some of the key principles of evidence-based investing include:

- The use of empirical data and analysis to inform investment decisions

- A focus on long-term results rather than short-term performance

- A commitment to diversification and risk management

- A reliance on evidence-based investment strategies, such as index investing and factor-based investing

- A rejection of speculation and market timing

Overall, evidence-based investing aims to assist investors in making more informed, logical investment decisions based on objective evidence and statistics rather than personal opinions or biases. Evidence-based investors rely on logic and statistics. They don’t try to forecast the future.

Here’s what you need to know to become an evidence-based investor:

Infographic Source: https://aurawealth.com/blog/the-principles-of-evidence-based-investing/

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal