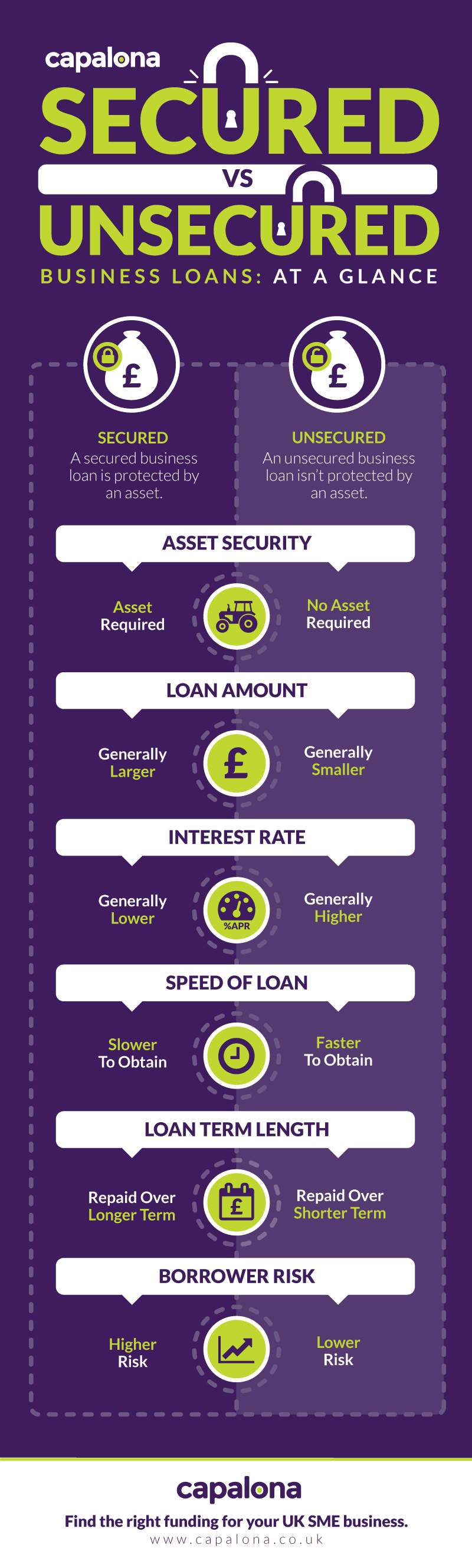

Many business owners will require some sort of financial cash boost at some stage to help with growth. With many ways to fund your business, here’s a quick round up of some of the main differences between unsecured and secured business loans.

Let’s start with secured business loans. This type of funding allows you to secure any business asset against the loan. You may receive a larger loan amount depending on the value of the asset you use, and with less risk for the lender, you will generally receive lower interest rates.

Unsecured business loans are the opposite. With no assets to secure against the loan, the lender will see it as a higher risk and generally offer lower loan amounts at higher interest rates.

Infographic Source: https://www.capalona.co.uk/news/whats-the-difference-between-secured-and-unsecured-business-finance/

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal