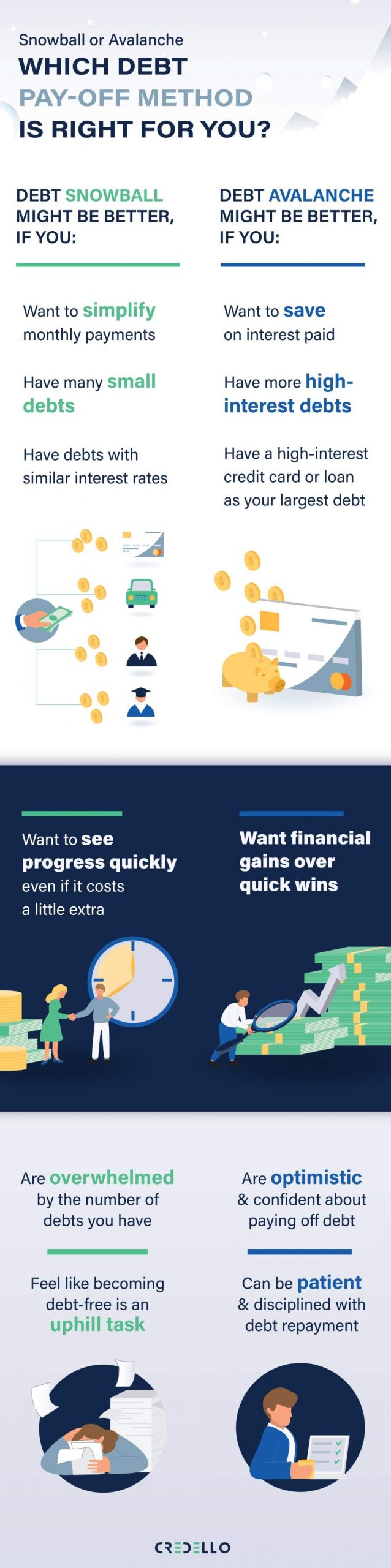

There can be quite a lot of confusion around debt payoff methods. There are pros and cons of both the Snowball method and Avalanche method. Though we provide all the facts and details when it comes to selecting a strategy, it really comes down to you and your specific financial situation.

But you can also use these strategies together, depending on what type of debt you have. For example, you could start by paying down something like revolving debt (credit card debt and lines of credit) with the snowball method. This means you are paying off the smallest payments quickly, but then once you have completed those you can pivot to the avalanche method and pay down debts with higher interest.

When selecting a method, it really comes down to your financial goals and priorities. The debt snowball method may be better if you want to start to feel like you are making progress with your debt sooner.

But if you have more high-interest debts and want to get out of debt sooner (assuming you make your payments on time) then this could be a better option for you.

Infographic Source: https://www.credello.com/debt/snowball-vs-avalanche/

Tags Avalanche Methods Repayment Snowball vs

Check Also

Top-10 Purposes to Take Small Loans

As of 2023, the US population is over 334 million. Did you know that every …

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal