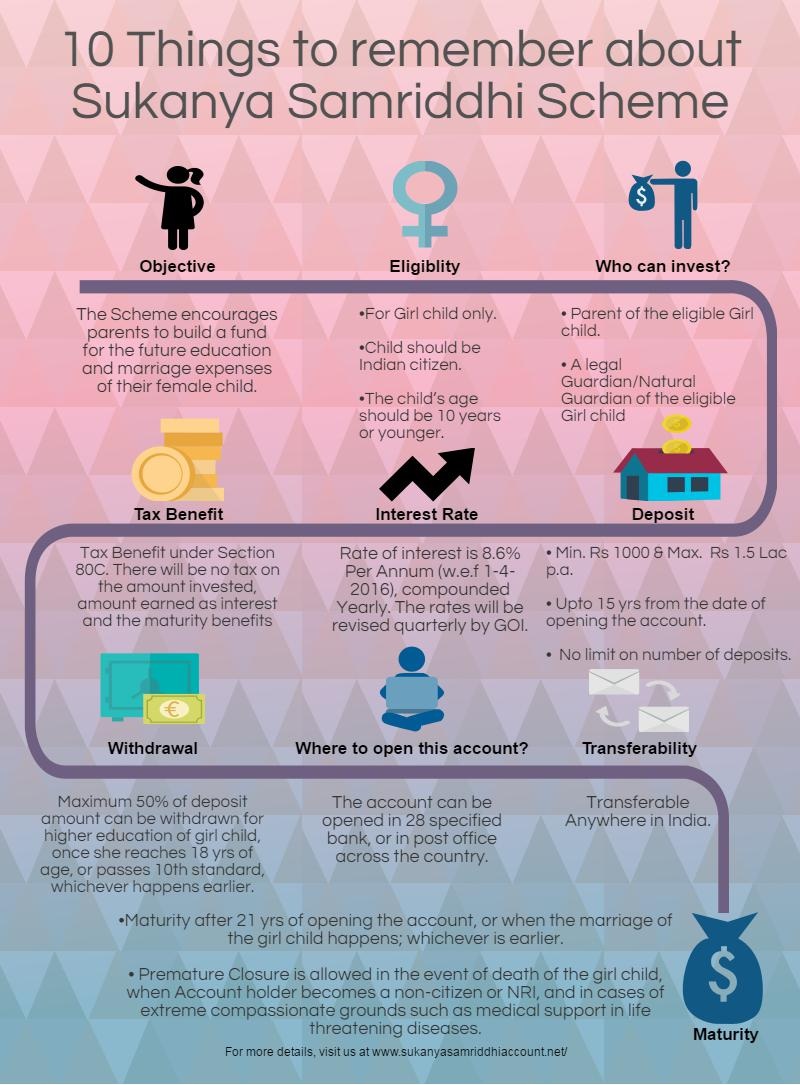

Sukanya Samriddhi Yojana is a small saving scheme started in 2015 under the Beti Bachao Beti Padhao program of Prime Minister Narendra Modi. The principle target of this scheme is to motivate higher education amongst girls by way of urging the parents to save a portion of their earnings for the better and secured future of their girl child.

Sukanya Samriddhi Yojana can be opened for a girl child who is an Indian Citizen and also Ten years or younger in age. The parents or the legal guardian of the girl child can open this account, but only in the name of the qualified Girl child. The account can be opened in 28 chosen banks or any post office across the nation and can be conveniently transferred anywhere in India.

This scheme is a long-term investment scheme where the parent/guardian has to deposit for 15 yrs from the date of opening the account. The deposit amount can be anything from Rs.1000 p.a to Rs. 1,50,000 p.a without having any prohibitions on the amount or the number of deposits. The scheme presently offers an Rate of interest of 8.6% p.a (w.e.f 1-4-2016), plus its greater than any other saving scheme in India. Be aware! These rates will probably be revised every quarter.

The Maturity of this account is 21 yrs from the date of opening the account and the sum after maturity will be paid to the Girl child. Partial withdrawal of 50% of the deposit for the higher education is allowed only if the girl reaches 18 years or passes 10th standard whichever is earlier. Otherwise, the Scheme forbids the account holder from making any other premature withdrawals.

Sukanya Samriddhi Yojana provides Tax Advantage under Section 80C. There will be no tax on the sum invested, sum gained as interest and the maturity gains.

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal