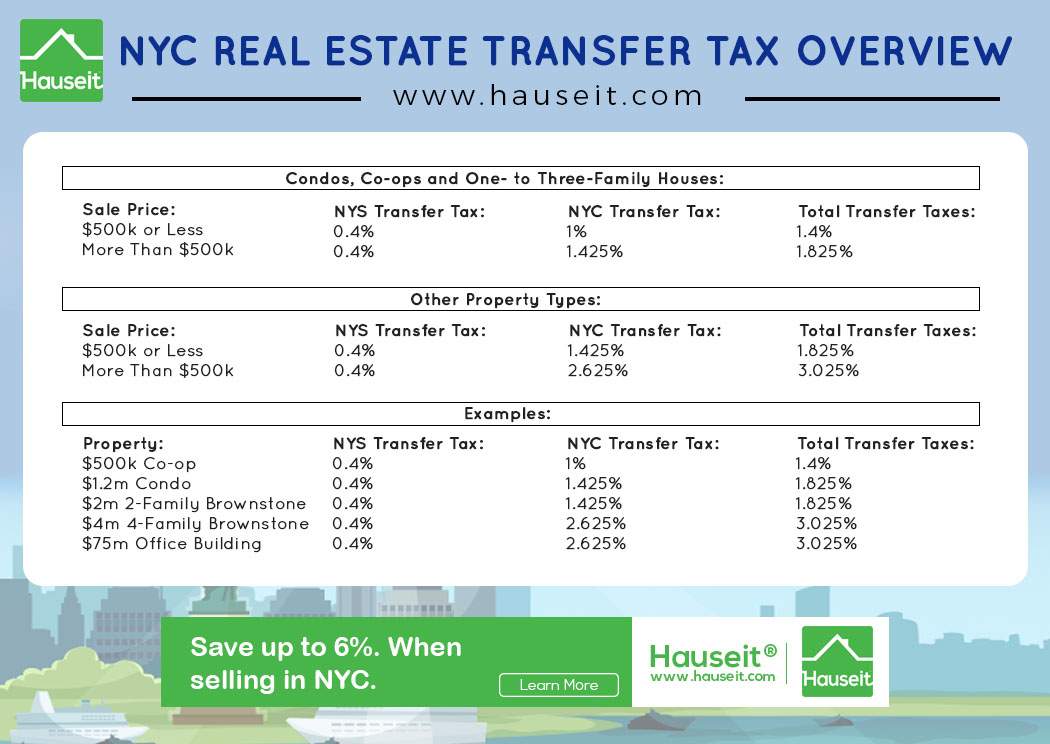

Seller transfer taxes in NYC are 1.4% for sales of $500k or less and 1.825% for anything more than $500k. These figures include the NYS Transfer Tax of 0.4%. The official NYC Transfer Tax rates are 1% and 1.425% for sales above $500k.

Real estate transfer taxes are the second highest closing cost for sellers after broker commissions. Overall seller closing costs in NYC are between 8% to 10%. Seller closing costs are the highest for co-ops because many co-op buildings charge an additional private Transfer Tax called the Flip Tax.

Estimate your seller closing costs in NYC using Hauseit’s interactive Closing Cost Calculator for Sellers. Seller closing costs include Transfer Taxes, broker fees, attorney fees, condo and co-op fees as well as miscellaneous bank and filing fees.

Transfer Taxes in NYC are customarily paid by sellers. The only exception to this is in the case of new developments and condo conversions or any other ‘sponsor’ sale which is the first sale from the original owner/developer to a buyer. In the case of a sponsor sale, it’s customary for the buyer to cover the seller’s closing costs which include NYC and NYS Transfer Taxes as well as sponsor legal fees.

Calculating the combined NYC & NYS Transfer Tax is as simple as multiplying the sale price by the applicable rate: 1.4% for anything at or below $500k and 1.825% for sales above $500k. Note that higher rates apply to any sales which are not condos, co-ops and one- to three-family properties.

Save up to 6% in commission when selling in NYC through Hauseit’s Agent Assisted FSBO Listing Service. We’ve helped buyers in New York City save millions of dollars in closing costs since we opened our doors in 2014, and we’d love to help you too.

Learn more at www.hauseit.com.

Infographic Source: https://www.hauseit.com/nyc-real-property-transfer-tax-rptt/

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal