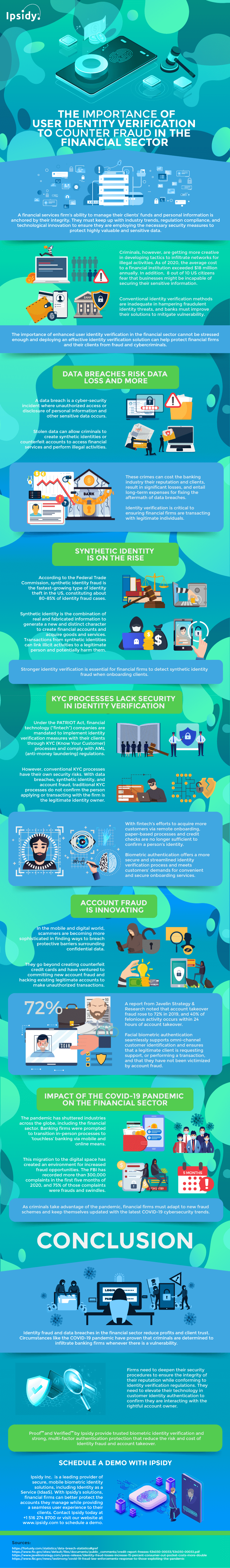

Fraud is still rampant in the financial sector, and criminals will look for vulnerabilities in the system to infiltrate companies. This illegal activity is often used to obtain valuable information, funds, or other assets entrusted to a financial firm.

Criminals can use stolen data to impersonate someone else or create a synthetic identity to access a bank’s services. Some use technology to hack into existing accounts and execute criminal acts on behalf of the real identity owner.

With these increasing threats, the financial industry is pushed to adopt tighter security to prevent criminals from carrying out their illicit plans. Most companies deploy identity verification methods before authorizing financial transactions.

It is imperative for banking institutions to confirm that the person trying to access their services is the legitimate identity owner.

Ipsidy provides the following infographic on the importance of implementing trusted user identity verification to counter fraud in the financial sector.

Infographic Source: https://www.ipsidy.com/blog/the-importance-of-trusted-user-identity-verification-to-counter-fraud-in-the-financial-sector-infographic

Tags Counter Fraud Financial Sector infographic user identity verification

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal