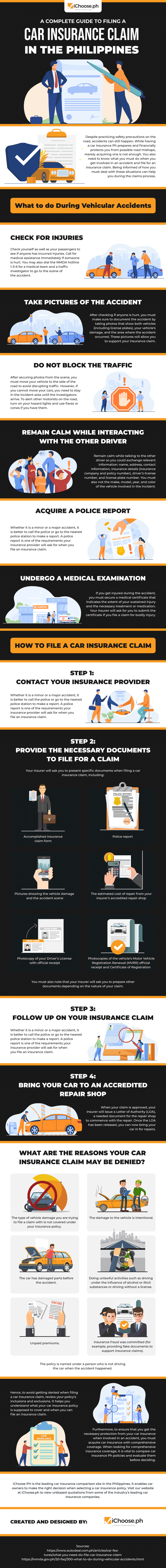

Despite observing safety measures and precautions, it is still a possibility that accidents can happen unexpectedly. In accidents on the road, it would be helpful to have a car insurance that can provide financial assistance from possible road mishaps. However, it may not be easy to do so, but there is still a need to know what needs to be done when one gets involved in an accident. Being informed on how to deal with situations like this can help during the claims process.

When it comes to vehicular accidents, the following steps must be done:

- Check for injuries

- Document and take pictures of the accident

- Do not block the traffic

- Remain calm while interacting with the other party involved

- Acquire a police report

- Undergo a medical examination

How to File a Car Insurance Claim

The first thing you need to do as you file for a car insurance claim is to contact your insurance provider that can help in walking you through the process.

Next is to provide the necessary documents needed to file for a claim, such as:

- Accomplished insurance claim form

- Police report

- Pictures showing the vehicle damage and the accident scene

- The estimated cost of repair from your insurer’s accredited repair shop

- Photocopy of your Driver’s License with an official receipt

- Photocopies of the vehicle’s Motor Vehicle Registration Renewal (MVRR) official receipt and Certificate of Registration

Following up on your insurance claim is the next step. The process can take about a month for some insurance companies due to thorough investigation and assessment of those involved and validation of the submitted documents.

Once the insurance claim is approved, a Letter of Authority (LOA) will be issued, a required document for the repair shop to start doing the needed repairs for a car.

However, there are also reasons why car insurance claims can be denied, as there are specific cases that the insurer would reject the claim. Some reasons that can disqualify you from filing an insurance claim can include:

- The type of vehicle damage you are trying to file a claim with is not covered under your insurance policy.

- The damage to the vehicle is intentional.

- The car had damaged parts before the accident.

- We are doing unlawful activities such as driving under the influence of alcohol or illicit substances or driving without a license.

If you are looking for more information about filing for a car insurance claim in the Philippines, here is an infographic:

Infographic Source: https://ichoose.ph/blogs/complete-guide-filing-car-insurance-claim-ph/

Infographic Portal New Infographics Resource Portal

Infographic Portal New Infographics Resource Portal